Loading

Get Ct W4na Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ct W4na Form online

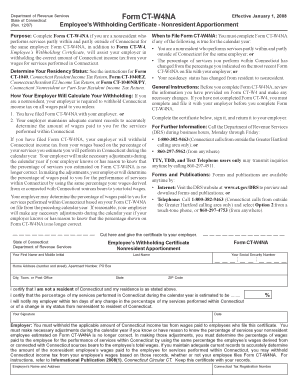

Filling out the Ct W4na Form online can streamline the process of ensuring the correct amount of Connecticut income tax is withheld from your wages. This guide provides detailed, step-by-step instructions tailored to users of varying experience levels.

Follow the steps to complete the Ct W4na Form effortlessly.

- Click ‘Get Form’ button to access the Ct W4na Form and open it for editing.

- Provide your last name in the appropriate field. Make sure to enter the name as it appears on your Social Security card.

- Enter your Social Security number accurately to ensure proper identification.

- Fill in your first name and middle initial in the designated spaces.

- Complete your home address, including the number and street, apartment number if applicable, city, state, and ZIP code.

- In the certification section, confirm that you are a nonresident of Connecticut and state your residence as provided above.

- Estimate and enter the percentage of your services that will be performed in Connecticut during the calendar year.

- Remember to commit to notifying your employer within ten days if there is any change in the percentage of services performed in Connecticut or if your residency status changes.

- Sign and date the certification at the bottom of the form to confirm the accuracy of the information provided.

- After completing the form, you can save your changes, download a copy for your records, print it out, or share it with your employer.

Complete your Ct W4na Form online today to ensure accurate tax withholding!

HOW TO OBTAIN CONNECTICUT TAX FORMS Connecticut state tax forms can be downloaded at the Department of Revenue Services (DRS) website: .ct.gov/drs/ Connecticut tax forms and publications are available at any DRS offices, during tax filing season.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.