Loading

Get Form Ct 945 2013

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form CT-945 2013 online

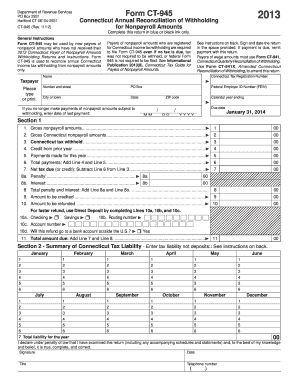

Form CT-945 is used for the annual reconciliation of Connecticut income tax withholding from nonpayroll amounts. This guide provides step-by-step instructions to assist users in completing the form online effectively and accurately.

Follow the steps to successfully complete your Form CT-945 online.

- Press the 'Get Form' button to download the Form CT-945 2013 and open it in an online editor.

- Provide your Connecticut tax registration number and name accurately in the designated fields. Ensure to enter your address, including the city, state, and ZIP code.

- Enter your Federal Employer Identification Number (FEIN) in the appropriate field.

- Indicate the calendar year ending for which you are filing by providing the correct date.

- In Section 1, complete Line 1 by entering the total gross nonpayroll amounts paid during the specified year.

- Complete Line 2 by entering the total nonpayroll amounts that are subject to Connecticut income tax withholding.

- On Line 3, input the total Connecticut tax that was withheld for the year.

- Record any credit from the prior year on Line 4.

- Document total payments made for the year on Line 5.

- Add Lines 4 and 5 together on Line 6 to get your total payments and credits.

- To determine your net tax due or credit, subtract Line 6 from Line 3. Record this value on Line 7.

- If applicable, calculate any penalties and interest on Lines 8a and 8b respectively, and total them on Line 8.

- On Line 9, enter the amount you want to credit to your next quarter. On Line 10, indicate the amount to be refunded.

- If you wish to receive your refund via direct deposit, complete Lines 10a, 10b, and 10c with your account information.

- Record the total amount due on Line 11 by adding Line 7 and Line 8 if applicable.

- Sign and date the return in the provided space to validate your filing.

- Finally, save your changes, and if necessary, download, print, or share the form as needed.

Complete your Form CT-945 online today to ensure timely processing.

Completing CT W4 requires you to provide personal information, including your filing status and the number of allowances you claim. Carefully read the instructions to understand how your choices impact your state withholding. Additionally, you can find helpful resources on uslegalforms that guide you through completing the CT W4 accurately, ensuring that your federal withholding aligns with the requirements of Form Ct 945 2013.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.