Loading

Get Ct 8379 2012 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ct 8379 2012 Form online

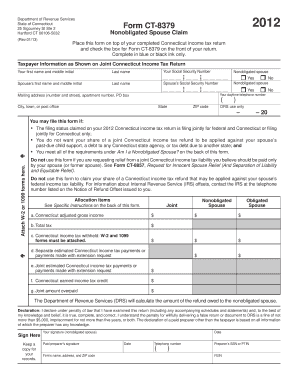

Filling out the Ct 8379 2012 Form online can streamline your process of claiming a refund as a nonobligated spouse. This guide provides clear, step-by-step instructions on how to effectively complete each section of the form, ensuring users understand their obligations and rights.

Follow the steps to accurately complete the Ct 8379 2012 Form.

- Press the ‘Get Form’ button to access the online form. This will allow you to open it in an editable format.

- Provide your tax information as shown on your joint Connecticut income tax return. Enter your first name, middle initial, last name, and Social Security Number.

- Enter your spouse’s Social Security Number, first name, and middle initial. Indicate whether you are the nonobligated spouse by selecting 'Yes' or 'No'.

- Fill in your daytime telephone number and mailing address, including the street address, apartment number (if applicable), city or town, state, and ZIP code.

- In the Allocation Items section, provide the Connecticut adjusted gross income, total tax, Connecticut income tax withheld from W-2 or 1099 forms, separate and joint estimated tax payments, Connecticut earned income tax credit, and joint amount overpaid.

- Complete the declaration section, signing the form as the nonobligated spouse. Include your date of signature.

- If applicable, have a paid preparer sign the form. They must include their name, firm's information, date, and identification numbers.

- Before finalizing, ensure all necessary attachments, such as W-2 or 1099 forms, are included. Save your changes, then download, print, or share the completed form as needed.

Start filling out the Ct 8379 2012 Form online to claim your nonobligated spouse refund today.

Taxpayers who may benefit from filing the Ct 8379 2012 Form include those who have filed jointly with a spouse that faces financial difficulties. If your spouse has unpaid debts that could affect your tax refund, this form is crucial. By understanding your eligibility, you can take proactive steps to protect your refund.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.