Get Instructions For Completing Irs Form 4506-t 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the instructions for completing IRS Form 4506-T online

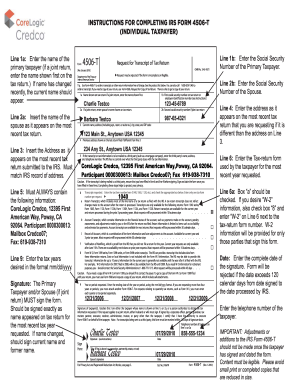

Filling out IRS Form 4506-T, Request for Transcript of Tax Return, can seem daunting, but with step-by-step instructions, it becomes a manageable task. This guide will help you navigate the form easily and accurately, ensuring you complete it properly to obtain the necessary tax information.

Follow the steps to complete IRS Form 4506-T online.

- Click the ‘Get Form’ button to access the online form. This will allow you to open the form in an editable format.

- In Line 1a, enter the name of the primary taxpayer as it appears on the most recent tax return. For joint returns, enter the name shown first. Ensure that if there has been a name change, the current name is entered.

- Proceed to Line 1b and enter the Social Security Number of the primary taxpayer. This information is critical for verifying your identity.

- For Line 2a, if applicable, input the spouse's name as it is listed on the most recent tax return. This is crucial for joint tax returns.

- In Line 2b, include the Social Security Number of the spouse. This is necessary for identification purposes in joint filing scenarios.

- Enter your current address on Line 3 as it appears on your latest tax return. The address must exactly match IRS records to avoid processing issues.

- If the address on your most recent tax return differs from Line 3, provide that address in Line 4.

- For Line 5, if the transcript is to be sent to a third party, include their name, address, and telephone number. Be cautious as the IRS cannot control how the third party utilizes this information.

- Line 6 requires you to specify the tax return form used for the most recent year requested by entering the form number, such as 1040, 1065, etc.

- On Line 9, enter the tax years desired in the format mm/dd/yyyy. This line is essential for ensuring the correct years are processed.

- After completing the form, review all entries for legibility and accuracy. Avoid any alterations once the form has been signed.

- Finally, sign and date the form in the indicated sections. Your signature must match the name on line 1a or 2a. Ensure the date is within the accepted timeframe to avoid rejections.

Take action now to complete IRS Form 4506-T online effortlessly and obtain your tax transcripts!

Yes, you can request a letter from the IRS, such as a tax transcript or a verification letter. To do so, complete the appropriate form like the 4506-T, which requires accurate information to process your request. Following the INSTRUCTIONS FOR COMPLETING IRS FORM 4506-T ensures you fill out the form correctly, making it easier to receive the needed letter from the IRS.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.