Loading

Get Arkansas Eft Ct Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Arkansas EFT CT Form online

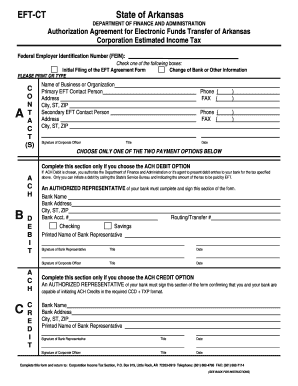

This guide aims to support users in completing the Arkansas EFT CT Form online for electronic funds transfer related to corporation estimated income tax. By following these clear, step-by-step instructions, you will efficiently navigate through each section of the form.

Follow the steps to complete the Arkansas EFT CT Form online

- Click ‘Get Form’ button to obtain the form and open it in your document editor.

- Enter your Federal Employer Identification Number (FEIN), ensuring it is a nine-digit number. This is essential for filing your Arkansas corporation income tax payments.

- Select the appropriate option by checking one of the boxes: if this is your initial filing of the EFT Agreement Form, or if you are updating previous bank or account details.

- In Part A, provide your business’s name, the name of the primary EFT contact person along with their contact details, and then repeat these steps for the secondary contact person. Both individuals should be knowledgeable about the EFT process.

- Sign the form where indicated by a corporate officer and include the date of signing.

- For ACH debit option, fill in your bank’s name, address, account number, and routing number, and indicate whether it is a checking or savings account. This enables your state taxes to be processed through your bank.

- Acquire the signatures from both the bank’s authorized representative and the corporate officer on the same section, along with the date signed.

- If you are opting for the ACH credit option, repeat the bank details entry and ensure the bank’s authorized representative also signs this part of the form, alongside the corporate officer.

- Once all sections are completed, ensure that you have retained a copy for your records. You may then download, print, or securely share the completed form as needed.

Complete your Arkansas EFT CT Form online today for a streamlined tax payment process.

You can pick up tax forms at local offices of the Arkansas Department of Finance and Administration or at certain public libraries. Additionally, many people find it more convenient to download forms online. Platforms like uslegalforms provide easy access to the Arkansas Eft Ct Form and other necessary documents, allowing you to fill them out from home.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.