Loading

Get Sba Form 2233 - Sba.gov - Sba

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SBA Form 2233 - SBA.gov - Sba online

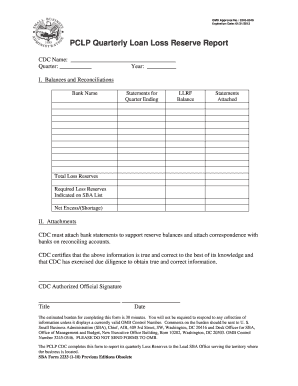

Filling out the SBA Form 2233 is an important step for community development corporations (CDCs) to report their quarterly Loss Reserves accurately. This guide will walk you through each section of the form, providing clear instructions to help you complete it online effectively.

Follow the steps to fill out the SBA Form 2233 accurately.

- Click ‘Get Form’ button to obtain the form and open it in your preferred document editor.

- Begin by entering the CDC name in the designated field at the top of the form. Ensure that the name is spelled correctly as it will be cited in official records.

- Fill in the quarter and year for which you are reporting loss reserves. This will help categorize the report appropriately.

- In section I, provide the name of the bank associated with your loss reserves and list the statements for the quarter ending. Attach related bank statements for verification.

- Complete the 'LLRF Balance' field by entering the total balance of the Loss Loan Reserve Fund as indicated in your records.

- Mark the box for 'Statements Attached' if you are including the necessary bank statements to support your balance entries.

- Indicate the total loss reserves required as per the indicated SBA list, ensuring the figures align with SBA guidelines.

- Calculate and enter the net excess or shortage in reserves. This amount reflects any discrepancy between your indicated reserves and required reserves.

- Proceed to section II and ensure you attach all required bank statements and correspondence relevant to your accounts. This documentation is essential for validation.

- Once all fields are filled and attachments are ready, the CDC authorized official needs to sign the form in the designated signature line. This certification ensures correctness to the best of your knowledge.

- Lastly, specify the title and date next to the signature, completing the form appropriately. You can then save changes, download, print, or share the filled form as needed.

Complete the SBA Form 2233 online today to ensure your reporting is timely and accurate.

Maximum SBA loan amount: Loans are generally capped at $5 million. Certain eligible energy-efficient or manufacturing projects may qualify for more than one 504 loan up to $5.5 million each. Interest rate: Below-market interest rates are fixed for the life of the loan.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.