Loading

Get Wta Form - Dfas

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Wta Form - Dfas online

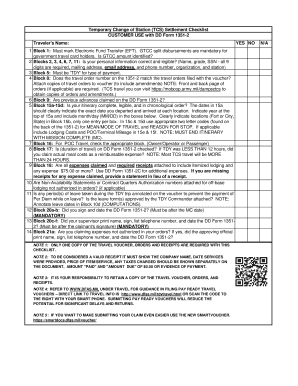

The Wta Form - Dfas is a crucial document for travelers seeking reimbursement for government-related travel expenses. This guide provides detailed, step-by-step instructions for completing the form online, ensuring a smooth filing process.

Follow the steps to complete the Wta Form - Dfas successfully.

- Access the Wta Form - Dfas online by clicking the ‘Get Form’ button to obtain the form and open it in the editor.

- In Block 1, mark the box for Electronic Fund Transfer (EFT). Confirm if the Government Travel Charge Card (GTCC) amount is identified for split disbursements, which are mandatory.

- Check Blocks 2, 3, 4, 6, 7, and 11 to ensure your personal information is correct and legible. This includes your name, grade, Social Security Number (all nine digits), mailing address, email address, phone number, organization, and station.

- In Block 5, ensure the type of payment is marked as 'TDY'.

- Verify the travel order number in Block 8 matches the travel orders filed with the voucher. Attach copies of the travel orders, including any amendments, ensuring to include both front and back pages if applicable.

- In Block 9, confirm that any previous advances claimed are listed on the DD Form 1351-2.

- Complete blocks 15a-15d with a detailed itinerary. Ensure that the dates in 15a indicate the exact day of departure and arrival at each location, using month/day (MM/DD) format. Clearly indicate locations in Block 15b, ensuring one entry per box. In Blocks 15c & 15d, use the two-letter codes for mean/mode of travel and reason for stop. If relevant, include lodging costs and mileage.

- For Point of Contact (POC) travel in Block 16, check the appropriate box for either Owner/Operator or Passenger.

- In Block 17, ensure the duration of travel is checked. If the TDY was less than 12 hours, claim any actual meal costs as reimbursable expenses.

- Verify that all expenses claimed in Block 18 have required receipts attached, including itemized lodging and any expenses of $75 or more. If receipts for any claimed expenses are missing, include a statement in lieu of a receipt.

- If applicable, attach Non-Availability Statements or Contract Quarters Authorization numbers for off-base lodging, not authorized in orders.

- Annotate any periods of leave taken during the TDY trip on the voucher to avoid the payment of Per Diem while on leave. Ensure leave forms are attached and approved by the TDY Commander.

- In Block 20a-b, sign and date the DD Form 1351-2 after the Mission Complete (MC) date.

- In Block 20c-f, have your supervisor print their name, sign, list their telephone number, and date the form after your signature.

- In Block 21a, if claiming unauthorized expenses, ensure the approving official has printed their name, signed, listed their phone number, and dated the form.

- After filling out all required fields, review your form thoroughly. Save your changes, download a copy, print it for your records, or share it as needed.

Complete your Wta Form - Dfas online today for a hassle-free reimbursement process.

To print your 1099-R from myPay, simply log into your account and navigate to the tax forms section. From there, locate your 1099-R form and select the option to print. If you need assistance with this process or have questions regarding your tax documents, USLegalForms can provide valuable support.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.