Get Form B22b

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form B22b online

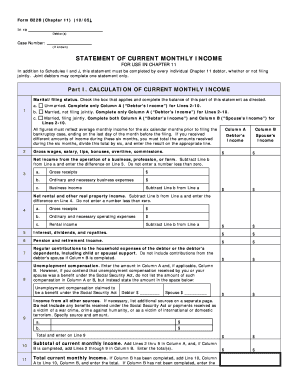

Filling out Form B22b is an essential step for individuals filing for Chapter 11 bankruptcy. This form helps calculate your current monthly income, which is crucial for your bankruptcy case. Completing it accurately ensures you provide the necessary information for a smoother filing process.

Follow the steps to effectively complete Form B22b online

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by confirming your marital or filing status at the top of Part I. Check the applicable box: Unmarried, Married not filing jointly, or Married filing jointly. This determines how you report income in the subsequent lines.

- For Line 2, report your gross wages, salary, tips, bonuses, overtime, and commissions. If applicable, also complete the corresponding column for your spouse's income.

- Proceed to Line 3, where you must calculate your net income from business operations (if any). Input gross receipts and ordinary business expenses to find this figure.

- In Line 4, report any net rental and real property income similarly by subtracting operating expenses from gross receipts.

- Continue with Lines 5 through 9, including interest, dividends, pensions, unemployment compensation, and any additional income sources, ensuring you provide amounts separately for your income and your spouse's (if applicable).

- After filling all applicable lines, calculate the subtotal of your current monthly income in Line 10. Make sure to sum Lines 2 through 9.

- In the verification section, sign and date the form to validate your entries. If this is a joint filing, ensure both debtors' signatures are included.

- Once you have completed the form, you can save changes, download, print, or share the form as needed.

Get started on completing your Form B22b online today.

To change your responsible party with the IRS, you must complete Form 8822-B and provide the new responsible party's information. This form allows you to officially notify the IRS of any changes in your business structure or management. It's essential to keep the IRS updated to avoid any issues with compliance. Our platform can guide you through this process, ensuring you have all the necessary forms and information at your fingertips.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.