Loading

Get Tr1 Ft 2020

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Tr1 Ft online

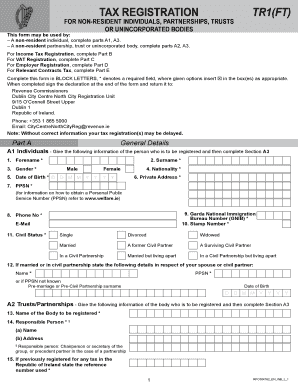

Filling out the Tr1 Ft form is an essential step for non-resident individuals, partnerships, trusts, or unincorporated bodies seeking tax registration in Ireland. This guide provides a clear, step-by-step approach to completing the form accurately and efficiently.

Follow the steps to successfully fill out the Tr1 Ft online.

- Click ‘Get Form’ button to retrieve the Tr1 Ft form and open it in your preferred document editor.

- Begin with Part A, 'General Details.' If you are registering as an individual, fill out A1 with your forename, surname, and gender. Ensure to input your nationality, date of birth, private address, PPSN, Garda National Immigration Bureau Number, email, phone number, and civil status. Additionally, if in a partnership, complete the relevant spouse or civil partner details.

- If you are registering as a partnership, trust, or unincorporated body, complete A2 with the name of the body, the responsible person’s details, and historical tax registration reference numbers if applicable.

- Move to part A3, 'Business Details.' Here, provide your trading name, legal format, business address, expected turnover, type of business, and details of your tax adviser if applicable.

- Proceed to part B for Income Tax registration. Indicate your main source of income and any establishments you have in Ireland.

- In part C, complete the VAT registration section by filling in the necessary information regarding your VAT activity and expected turnover.

- For Employer Registration in part D, indicate if you plan to engage employees, providing necessary details such as the date you wish to register and employee residency status.

- Lastly, complete part E for Relevant Contracts Tax registration if applicable, providing contract details along with the principal contractor's name and location.

- After completing all sections, do not forget to sign the declaration at the end of the form, affirming the truthfulness of your provided information.

- Once you have filled out the form thoroughly, save your changes, and proceed to download, print, or share the completed Tr1 Ft form as needed.

Start filling out your Tr1 Ft form online today for a smooth tax registration process.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

To get a VAT number in Ireland, start by completing the TR1 form. This form requires details about your business, including your anticipated turnover. After submission, Revenue will process your application and issue your VAT number once approved. The US Legal platform can help you with tips and templates to ensure your application is accurate.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.