Get Omb No 1845 0059

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the OMB No 1845 0059 online

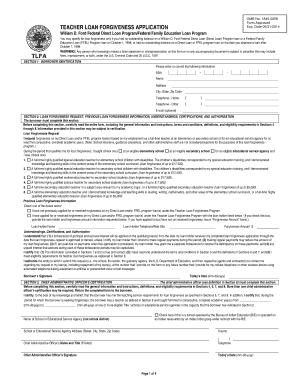

The OMB No 1845 0059 form, also known as the Teacher Loan Forgiveness Application, is designed to assist eligible teachers in obtaining loan forgiveness after fulfilling specific teaching requirements. This guide provides clear, step-by-step instructions to help users conveniently complete the form online.

Follow the steps to successfully fill out your Teacher Loan Forgiveness Application.

- Click the ‘Get Form’ button to obtain the form and open it in your preferred editing tool.

- In Section 1, enter your borrower identification information including your Social Security Number, name, address, city, state, zip code, and telephone numbers. Providing an email address is optional.

- Proceed to Section 2 to request loan forgiveness by filling in your employment details as a full-time teacher. Check the appropriate boxes regarding your teaching role and the educational institution where you worked.

- Complete the Previous Loan Forgiveness Information section by indicating whether you have applied for or received forgiveness before. If applicable, provide the loan holder's name and forgiveness amount.

- Read and acknowledge the Understandings, Certifications, and Authorization section. Ensure that the information you’ve provided is accurate and sign the application.

- Move on to Section 3, which requires the Chief Administrative Officer of your school to certify your teaching service. Leave this section blank until it is completed by the relevant authority.

- Review Sections 4 through 8 which include important information and definitions related to loan forgiveness eligibility. Ensure you understand all terms before finalizing your application.

- Finalize the application by saving your changes, and consider downloading, printing, or sharing the form as necessary. Follow the submission instructions provided in Section 9.

Complete your Teacher Loan Forgiveness Application online today to start your journey towards loan forgiveness.

Yes, PPP loans under $50,000 may qualify for automatic forgiveness, provided you meet specific criteria set by the SBA. This includes maintaining employee levels and using the funds for eligible expenses as outlined in Omb No 1845 0059. To navigate the application process smoothly, consider using US Legal Forms to ensure you complete the necessary requirements accurately.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.