Loading

Get Form 8857 Revised September 2010

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 8857 Revised September 2010 online

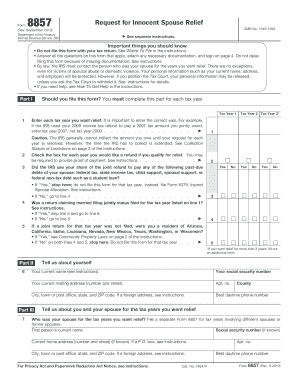

This guide provides a comprehensive overview on how to fill out the Form 8857, Request for Innocent Spouse Relief, online. By following these steps, users will be able to navigate through the form with ease and ensure that all necessary information is submitted accurately.

Follow the steps to fill out Form 8857 with confidence.

- Click the ‘Get Form’ button to access the document and open it for completion.

- Complete Part I by determining if you should file this form for each tax year. Enter the tax years you seek relief for, ensuring the accuracy of your entries.

- In Part II, provide your personal information including your current name, social security number, and mailing address. Ensure all fields are filled out completely.

- Use Part III to describe your relationship with your spouse during the relevant tax years, including current marital status and any associated documents, such as a divorce decree if applicable.

- Address questions regarding your financial situation and involvement in tax returns within Part IV. Be thorough and check all that apply, providing explanations where necessary.

- In Part V, detail your current financial situation along with your household income and expenses. It's essential to report accurately to reflect your financial standing.

- Review all entries for accuracy and completeness before finalizing your submission. If you need extra space for any answers, attach additional pages with your name and social security number.

- Once all sections are completed, you may save changes, download, print, or share the form as required before submitting your request.

Begin filling out your Form 8857 online today to take the necessary steps towards resolving your tax relief needs.

To file a 2010 tax return, you need to obtain the appropriate forms for that tax year from the IRS website. Complete the return accurately, including all necessary information about your income and deductions. If you encounter joint liability issues, consider using Form 8857 Revised September 2010 to seek relief while filing your return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.