Loading

Get 100s Instructions

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 100s Instructions online

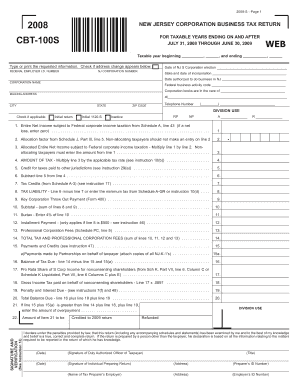

This guide provides comprehensive, step-by-step instructions to assist users in filling out the 100s Instructions online. Follow these clear guidelines to ensure accurate completion of the form.

Follow the steps to successfully fill out the 100s Instructions.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the required detail at the top of the form, including the Federal Employer Identification Number, New Jersey Corporation Number, and contact information.

- Complete the 'Accounting Period' section accurately, noting the period covered by the tax return.

- Fill in the income details on the form, ensuring you calculate net income according to the guidelines provided.

- Carefully review the deductions and ensure that they comply with the instructions laid out in the attached guidelines.

- If applicable, complete all required schedules indicated by 'X' for your taxpayer class.

- Double-check all entries for accuracy and completeness before submission.

- Once the form is completed, save changes or choose to print for your records.

- Submit your completed form to the designated address before the deadline.

- If necessary, share the completed form with relevant parties, such as shareholders, ensuring to abide by legal obligations.

Complete your documents online to ensure timely and accurate submissions.

Related links form

You can file California Form 100S electronically through the California Franchise Tax Board’s website or send a paper version to their mailing address. It's essential to use the correct address based on the method of filing. Ensure that you follow the 100s instructions for any specific details regarding your filing. Consulting uslegalforms can provide additional support in this process.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.