Get Wisconsin 1npr Fill In Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Wisconsin 1npr Fill In Form online

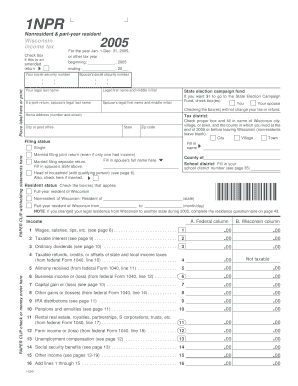

The Wisconsin 1npr Fill In Form is essential for nonresident and part-year resident taxpayers. This guide provides clear, step-by-step instructions on how to complete the form online, ensuring you have all the necessary information needed for a successful filing.

Follow the steps to complete your Wisconsin 1npr Fill In Form online effectively.

- Press the ‘Get Form’ button to access the Wisconsin 1npr Fill In Form, which you can then open in your preferred editor.

- Input your social security number and your legal name in the designated fields. Ensure that you accurately enter your spouse’s details if filing jointly.

- Check the box if this is an amended return, and specify your filing year at the top of the form.

- Provide your home address including the number, street, city, and zip code. Indicate your filing status, whether single, married filing jointly, or married filing separately.

- Select your resident status: full-year resident of Wisconsin, nonresident, or part-year resident, and fill in related details as necessary.

- Complete the income section by entering values for wages, interest, and other sources of income as listed. Ensure to follow the provided guidelines for each type of income.

- Proceed to list any adjustments to income such as educator expenses or self-employment tax. Accurate completion of these fields is crucial.

- Calculate and enter your adjusted gross income and Wisconsin income as required. Double-check all mathematical entries to avoid errors.

- Fill in your tax computation, considering any deductions and credits applicable to your situation.

- Finally, review the entire form for accuracy. Save your changes, and choose to download, print, or share the filled form as necessary.

Start filling out your Wisconsin 1npr Fill In Form online today to ensure timely and accurate submission.

To fill in a tax return step by step, start by collecting all necessary documents like W-2s, 1099s, and any relevant receipts for deductions. Then, follow the instructions on the tax form, entering your information carefully in each section. Be sure to double-check your entries for accuracy. For a seamless experience, consider using the Wisconsin 1npr Fill In Form, which guides you through each step and ensures that you do not miss any critical details.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.