Loading

Get Td4 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Td4 Form online

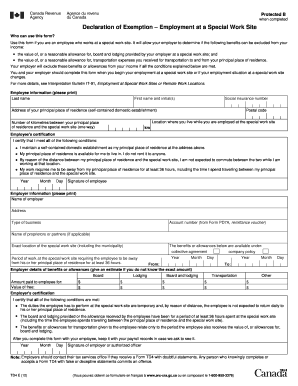

Filling out the Td4 Form online is an essential step for employees working at special work sites. This guide provides clear and comprehensive instructions to help you accurately complete the form and ensure that you receive any applicable benefits.

Follow the steps to effectively complete the Td4 Form online.

- Press the ‘Get Form’ button to obtain the Td4 Form, which will open for you to fill out online.

- Begin with entering your personal information in the 'Employee Information' section, including your first name, initials, last name, and social insurance number.

- Provide the address of your principal place of residence, including the postal code, followed by the location where you will reside while employed at the special work site.

- Indicate the number of kilometers between your principal residence and the special work site, calculated one way.

- In the 'Employee's Certification' section, confirm your eligibility by checking the required statements. Ensure your signature and the date are included.

- Next, fill in the 'Employer Information' section with the necessary details about your employer, including their name, address, and business type.

- If applicable, include the names of proprietors or partners, and provide the exact location of the special work site, including municipality details.

- Complete the section regarding benefits or allowances, and estimate the amounts if exact values are unknown. Specify amounts for lodging, board, and transportation.

- Finally, in the 'Employer's Certification' section, ensure that your employer signs and dates the form. They must also verify that all required conditions are met before submission.

- Once all sections are filled out correctly, save your changes, then download, print, or share the completed form as needed.

Complete your documents online today and ensure you do not miss any benefits!

To fill out a W-4 employee's withholding certificate, start by providing your personal information, such as your name and address. Next, indicate your filing status and claim any allowances or additional withholding amounts. While the W-4 is separate from the TD4 Form, ensuring accurate withholding can help you manage your tax obligations more effectively.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.