Loading

Get Gst Manual Transaction 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Gst Manual Transaction online

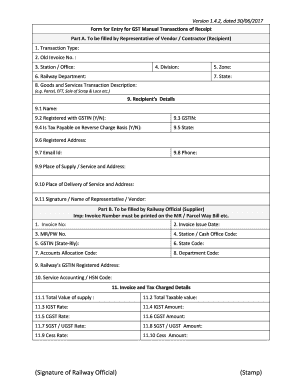

Filling out the Gst Manual Transaction form is crucial for documenting various transactions related to goods and services. This guide will provide you with clear, step-by-step instructions to help you complete the process online.

Follow the steps to complete the Gst Manual Transaction form accurately.

- Click ‘Get Form’ button to access the Gst Manual Transaction and open it in your preferred editor.

- In Part A, select the 'Transaction Type' from the options available, which may include Collection, Refund, or Adjustment.

- Enter the 'Old Invoice No.' if applicable to the transaction.

- Provide the 'Station / Office' name where the transaction is being recorded.

- Specify the 'Division' related to the transaction.

- Indicate the 'Railway Department' responsible for the transaction.

- Select the 'Zone' related to the location of the transaction.

- Enter the 'State' where the transaction is taking place.

- Describe the 'Goods and Services Transaction' succinctly to reflect the nature of the transaction.

- Fill in the recipient's details, including 'Name,' 'GSTIN' registration status, and 'Contact Information' such as Email Id and Phone.

- Provide the 'Place of Supply / Service' and 'Place of Delivery of Service' addresses.

- Include the 'Signature / Name of Representative / Vendor' to verify the information provided.

- In Part B, the Railway Official will complete the necessary fields, starting with 'Invoice No' and 'Invoice Issue Date.' Ensure the Invoice Number is 16 characters long.

- Enter the 'MR/PW No.' that corresponds to the transaction.

- Fill in the 'Station / Cash Office Code' related to the transaction.

- Provide the Railway's GSTIN and the registered address.

- Record the 'Service Accounting / HSN Code' associated with the service provided.

- Complete the 'Invoice and Tax Charged Details' with appropriate values, including total supply value, taxable value, tax rates, and amounts for IGST, CGST, and SGST.

- Once all sections are filled, you can save changes, download the completed form, print it, or share it as needed.

Start filling out the Gst Manual Transaction online to ensure your documentation is completed accurately.

Filing GSTR 3B manually involves collecting details of your inward and outward supplies. Once you have this information, fill out the GSTR 3B form with accurate figures. After reviewing your entries for correctness, submit the GSTR 3B manually through the GST portal, completing your Gst Manual Transaction effectively.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.