Loading

Get Mfc Finance For Blacklisted

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Mfc Finance For Blacklisted online

Filling out the Mfc Finance For Blacklisted form online can be a straightforward process if you understand each section and its requirements. This guide provides detailed instructions to help you navigate through the form effectively.

Follow the steps to complete your application confidently.

- Click ‘Get Form’ button to obtain the form and open it for editing.

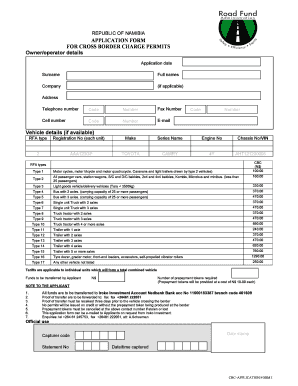

- Begin by filling out the owner/operator details section. Include your application date, surname, full names, company (if applicable), and contact information such as your address, telephone number, fax number, and email.

- Next, fill in the vehicle details section, if applicable. Specify the type (RFA type) of your vehicle, its registration number, make, series name, engine number, and chassis number (VIN).

- Choose the appropriate RFA type from the list provided, which categorizes vehicles into various types based on classification. Ensure you indicate the correct vehicle specifications.

- Enter the total cost for the cross-border charge permits based on the selected RFA type, and calculate the number of prepayment tokens required. Remember, each token costs N$ 10.00.

- Transfer the required funds to the specified Iroko Investment Account using the provided banking details. Keep in mind that proof of transfer must be forwarded to the designated fax number.

- In the final section, review all the information entered for accuracy, and ensure that all necessary documents are prepared to support your application. Save your changes and, if needed, you can then download, print, or share the form.

Complete your Mfc Finance For Blacklisted application online today!

Yes, blacklisting does expire after a certain period, usually between five to seven years. Once the blacklisting period ends, you can work towards rebuilding your credit. Mfc Finance For Blacklisted encourages individuals to take proactive steps during this time to enhance their financial health and prepare for future financing opportunities.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.