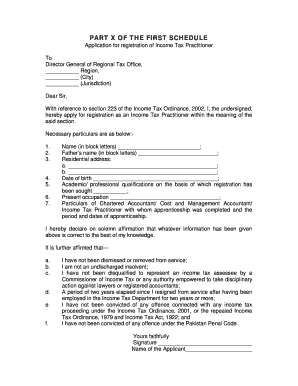

Get Part X Of The First Schedule Application For Registration Of Income Tax Practitioner To Director

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PART X OF THE FIRST SCHEDULE Application For Registration Of Income Tax Practitioner To Director online

This guide provides a clear and supportive approach to completing the PART X OF THE FIRST SCHEDULE Application For Registration Of Income Tax Practitioner to the Director. Follow these steps to ensure accurate and successful submission of your application online.

Follow the steps to complete your application efficiently.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin filling in your name in block letters as indicated in the form.

- Next, provide your father’s name in block letters.

- Input your residential address in the specified sections, ensuring to include all required lines.

- Enter your date of birth in the format requested by the form.

- Specify your academic and professional qualifications pertinent to your registration.

- Outline your present occupation clearly and accurately.

- Detail the particulars of the Chartered Accountant, Cost and Management Accountant, or Income Tax Practitioner with whom you completed your apprenticeship, including the duration and dates.

- Complete any required declarations affirming the truth of the information provided, ensuring you review each statement.

- Sign the application in the designated space and print your name beneath it.

- Provide your office address and date of submission.

- Once all sections are filled, save your changes, download, print, or share the form as necessary.

Begin your journey to becoming an Income Tax Practitioner by completing the application online today.

When preparing your Schedule 1, you will typically need documentation such as your tax returns, income statements, and any relevant deductions or credits. Additionally, if you are using the PART X OF THE FIRST SCHEDULE Application For Registration Of Income Tax Practitioner To Director, you may need to provide proof of your tax practitioner qualifications. It is essential to gather all necessary documents to ensure a smooth application process.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.