Get Dt Form How Do Fill

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Dt Form How Do Fill online

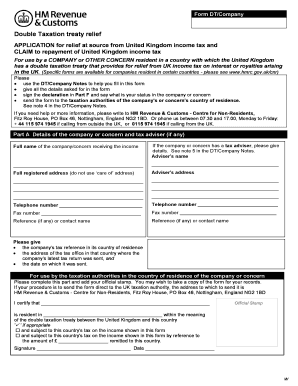

Filling out the Dt Form How Do Fill online can streamline the process of applying for relief at source from United Kingdom income tax. This guide will provide clear, step-by-step instructions tailored to your needs, ensuring that you have all the necessary information to complete the form accurately.

Follow the steps to successfully complete the Dt Form How Do Fill online.

- Click the ‘Get Form’ button to obtain the form and open it in your preferred editor.

- Begin by filling out Part A with details of the company or concern, including the full name, registered address, and tax adviser information if applicable.

- In Part B, answer the questions about the company or concern, ensuring you tick the appropriate boxes and provide additional details where required.

- Proceed to Part C to apply for relief at source from UK income tax. Complete the relevant section (C1, C2, or C3) based on the nature of the income.

- If you are claiming repayment for UK income tax already deducted, fill out Part D with the necessary income details, including the source of income and amounts.

- If applicable, complete Part E to authorize a bank or other nominee to receive the repayment on your behalf.

- Finally, sign the Declaration in Part F confirming that the information is correct and complete. Make sure to indicate your status within the company.

- Once completed, save your changes, and you can download, print, or share the form as needed.

Take the next step and complete the Dt Form How Do Fill online today for easy processing of your tax relief application.

Filling in a tax return step by step involves several crucial stages. Begin by collecting all necessary documentation, including income statements, deductions, and credits. Next, accurately fill out each section of the return, using the DT Form as needed for specific income types or treaty claims. To simplify the process, you can utilize the resources available on the US Legal Forms platform, which guide you through each step of filling your tax return.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.