Loading

Get Completable P11d 2012 2013 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Completable P11d 2012 2013 Form online

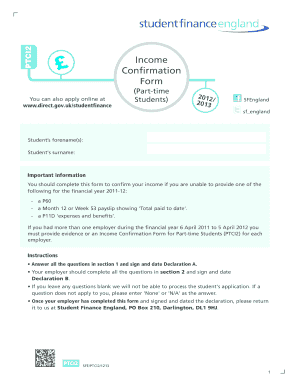

The Completable P11d 2012 2013 Form is essential for confirming your income if you cannot provide specific financial documents for the 2011-12 financial year. This guide will help you navigate each section of the form with clear instructions to ensure accurate completion.

Follow the steps to successfully complete your form online.

- Click the ‘Get Form’ button to acquire the form and open it in the editor.

- In section 1, fill in the personal details required for both the student and the person completing the form. This includes entering the student’s full name, date of birth, and customer reference number.

- Once section 1 is complete, ensure that Declaration A is signed and dated. If the student cannot sign, a Power of Attorney must sign on their behalf, with the necessary documentation attached.

- In section 2, the employer must complete their part. This includes providing the employee’s job title and gross salary before any deductions.

- Next, the employer should detail any taxable benefits in kind by providing the amount and description of each benefit, as well as total pension contributions deducted during the financial year.

- Verify whether the employee was employed for the entire financial year. If not, specify the duration of their employment in the provided fields.

- Ensure Declaration B is signed and dated by the employer, providing their name, position, and the name and address of the employer's firm.

- After completing all sections and declarations, verify all information for accuracy. Save your changes, and you can choose to download, print, or share the form as needed.

Start completing your documents online today for a seamless submission experience.

To print a P11D form, first ensure that you have filled it out completely on your computer. Once you are satisfied with the information, select the print option from your document settings. If you are using the uslegalforms platform, printing the Completable P11D 2012 2013 Form is straightforward, allowing you to get a hard copy quickly and efficiently.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.