Get M T Securities Ira

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the M T Securities Ira online

This guide provides a clear and comprehensive overview of how to complete the M T Securities Ira form online. Whether you are a first-time filer or familiar with the process, the following steps will help ensure that your form is filled out accurately.

Follow the steps to successfully complete the M T Securities Ira form.

- Click the ‘Get Form’ button to access the M T Securities Ira form and open it in your preferred editor.

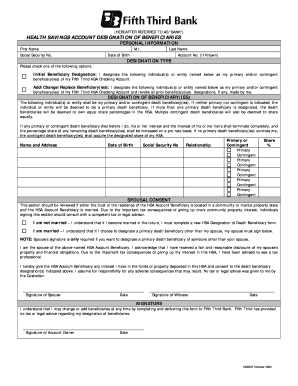

- Begin with the personal information section. Fill in your first name, middle initial, last name, and social security number. Also, enter your date of birth and account number if you have it.

- In the designation type section, select whether this is an initial designation or an add/change/replace designation by checking the appropriate box.

- Move to the designation of beneficiary(ies) section. Here, provide the names, dates of birth, social security numbers, relationships, and the share percentage for each primary and contingent beneficiary you wish to designate.

- Review the spousal consent section carefully if you are married. If you are not married, select the appropriate acknowledgment option. If you are married and wish to designate a primary beneficiary other than your spouse, ensure your spouse signs in the designated area.

- Finally, complete the signature section. Sign and date the form as the account owner to acknowledge your understanding of the beneficiary designations and their tax implications.

- Once you have reviewed the completed form for accuracy, you can save changes, download, print, or share the document as needed.

Complete your M T Securities Ira form online today for an efficient and hassle-free experience.

Investing in a Master Limited Partnership (MLP) within an M&T Securities IRA is possible, but there are specific considerations. MLPs can generate income through distributions, which may have tax implications for your IRA. It's essential to understand how these investments work and how they might impact your retirement strategy. For tailored advice on MLPs and other investment options, uslegalforms offers resources that can support your decision-making.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.