Loading

Get W9 Form 2003.xls

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the W9 Form 2003.xls online

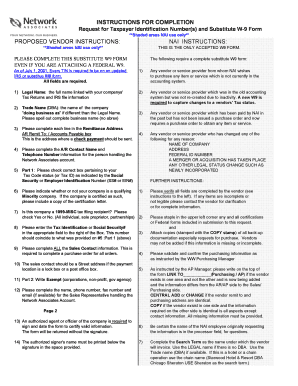

Filling out the W9 Form 2003 is an essential task for vendors providing services and goods. This guide will walk you through the process of completing the form online, ensuring that all necessary information is provided accurately.

Follow the steps to complete the W9 Form 2003 online.

- Click the 'Get Form' button to access the W9 Form 2003.xls and open it in the editor.

- Enter your legal name, which is the complete name associated with your business. Ensure that it matches the name used for your Tax Identification Number.

- If applicable, provide your trade name (also known as 'doing business as'). This should differ from your legal name if necessary and must be written fully without abbreviations.

- Complete the remittance address. This is where any payments should be sent, which may include a street address or a P.O. Box.

- Fill out the A/R Contact Name and Telephone Number, identifying the individual responsible for managing your account with the organization.

- In Part 1, check the box that corresponds with your Tax Code status, indicating if you are an individual, corporation, partnership, etc.

- Indicate if your company qualifies as a minority-owned business, including a copy of your certification letter if applicable.

- Answer whether your business is a recipient of 1099-MISC payments by marking 'Yes' or 'No'. Remember to enter your Tax Identification Number accurately.

- Complete all Sales Contact information, including name, phone number, fax number, and email if available. This is critical for processing purchase orders.

- Ensure the form is signed and dated by an authorized agent or officer of the company to certify that the provided information is valid.

- Review all entries for accuracy. Once completed, you can save your changes, download a copy, print it, or share the form as needed.

Start filling out your W9 Form 2003 online today to ensure timely processing of your requests and payments.

Yes, you can submit a W9 form electronically, but it depends on the recipient's process. Many businesses now accept electronic submissions of the W9 Form 2003.xls, streamlining the process. Ensure you confirm with the requester about their preferred submission method, and consider using secure platforms like uslegalforms to manage your documents safely.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.