Get Montclair State University Student/spouse Non-filing Statement 2019

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Montclair State University Student/Spouse Non-Filing Statement online

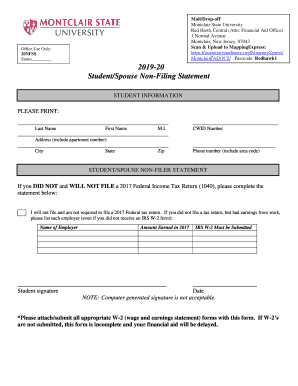

Filling out the Montclair State University Student/Spouse Non-Filing Statement is an essential step for students and their partners who are not filing a federal income tax return. This guide provides a clear, step-by-step approach to assist you in completing the form accurately online.

Follow the steps to confidently complete your Non-Filing Statement.

- Click ‘Get Form’ button to obtain the form and open it in the online editor.

- Begin by entering your student information in the designated fields. This includes your last name, first name, middle initial, address (make sure to include any apartment number), city, state, zip code, CWID number, and phone number with the area code.

- In the Student/Spouse Non-Filer Statement section, indicate whether you did not and will not file a 2017 Federal Income Tax Return (1040). You will need to confirm that you will not file and are not required to file a 2017 federal tax return.

- If you did have earnings from work, it is important to list each employer in the provided space, even if you did not receive an IRS W-2 form. Input the name of the employer and the total amount earned in 2017.

- Sign and date the form in the designated area. Note that a computer-generated signature is not acceptable, and ensure that you have attached all appropriate W-2 forms, as failure to submit these will make your form incomplete and could delay your financial aid.

- Once all sections are filled out and verified for accuracy, you can save your changes, download the form, or print it to submit. Make sure to follow the submission guidelines provided by the university.

Complete your Montclair State University Student/Spouse Non-Filing Statement online today to ensure your financial aid processing is not delayed.

Get form

Filing separately when married can lead to potential challenges, but you generally won’t face trouble if done correctly. It’s essential to file accurately and consider if a Montclair State University Student/Spouse Non-Filing Statement is necessary. Misfiling could raise red flags, so always ensure your submissions comply with IRS guidelines.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.