Loading

Get Form N 101a 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form N 101a 2012 online

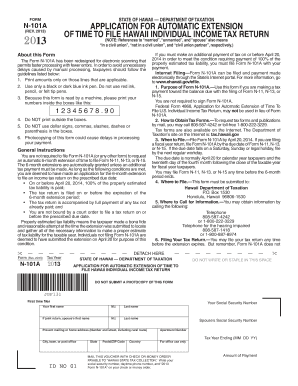

Filling out Form N 101a for an automatic extension of time to file your Hawaii individual income tax return can seem daunting. This guide will provide you with clear instructions to complete the form efficiently and accurately online.

Follow the steps to complete Form N 101a online.

- Click ‘Get Form’ button to obtain the form and access it in your preferred editing program.

- Print your name, address, and Social Security Number in the designated spaces. If filing jointly, include your partner's name and Social Security Number as well.

- If you have a foreign address, fill in the complete country name. If applicable, enter your Individual Taxpayer Identification Number (ITIN) issued by the IRS.

- Specify the date that your tax year ends and indicate the amount of payment you are submitting.

- Detach the payment voucher from the form where indicated. Only submit the voucher portion along with your payment.

- Ensure your payment is in U.S. dollars and made out to 'Hawaii State Tax Collector.' Write your Social Security Number, daytime phone number, and '2013 Form N-101A' on the check or money order.

- Once all fields are accurately filled out, you can save the changes, download, print, or share the completed form as necessary.

Start filling out your Form N 101a online today to ensure timely submission!

Yes, you can file a Hawaii tax return electronically. The state allows electronic filing for various forms, including Form N 101a 2012. Using services like US Legal Forms makes this process easier by providing the necessary forms and filing instructions tailored for Hawaii residents.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.