Loading

Get Az 140ptc

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Az 140ptc online

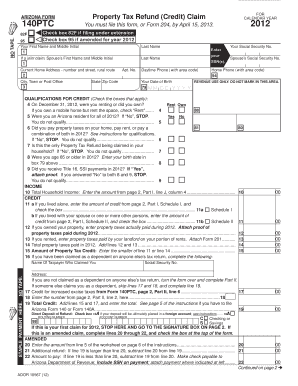

The Az 140ptc is a vital document for individuals claiming property tax refunds in Arizona. This guide will walk you through the steps to fill out the form online, ensuring that you provide all necessary information accurately.

Follow the steps to fill out the Az 140ptc form online

- Press the ‘Get Form’ button to obtain the Az 140ptc form and access it in your online editor.

- Complete your personal information at the top of the form, including your first and last name, current home address, Social Security number, date of birth, and contact information.

- Indicate your filing status by checking the appropriate boxes for extensions or amendments, if applicable.

- Answer qualification questions by selecting 'Rent' or 'Own' for your living situation on December 31, 2012, confirming your residency in Arizona for the entire year, and detailing the property taxes paid during 2012.

- Fill in your total household income based on the provided guidelines, ensuring accuracy as this will determine your eligibility for credit.

- Complete sections related to property tax credit amounts, indicating the credit you qualify for based on your situation and providing any necessary supporting documentation.

- Review the form for completeness and accuracy before proceeding to save your changes, download the document, or print it for mailing.

Complete the Az 140ptc form online today to ensure your property tax refund claim is processed promptly.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

To claim the Arizona solar tax credit, you must install a solar energy system on your property and meet the necessary requirements. This tax credit allows you to receive a percentage of the installation costs back on your state taxes. It's essential to complete the Arizona Form 140 and attach any supporting documents to your application. For more streamlined assistance, check out the resources on US Legal Forms.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.