Get Ny Char500 2019-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY CHAR500 online

The NY CHAR500 is an essential document for charitable organizations operating in New York. This guide will walk you through the process of completing the CHAR500 online, ensuring that your organization meets all necessary filing requirements accurately and efficiently.

Follow the steps to successfully complete your CHAR500 form online.

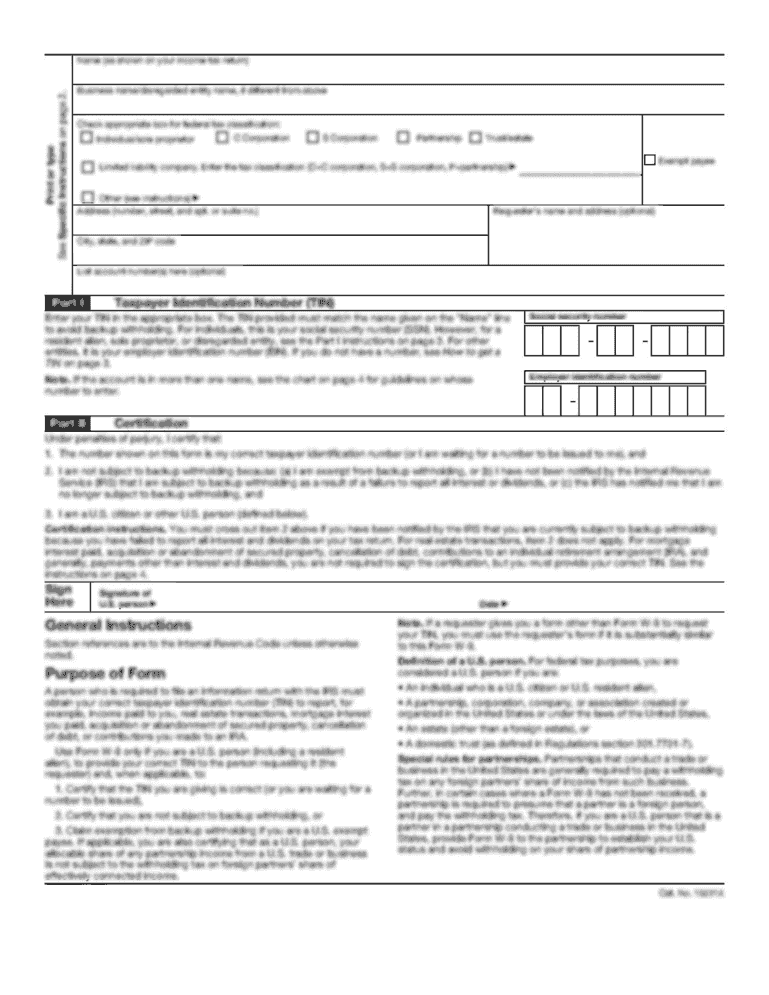

- Press the ‘Get Form’ button to access the CHAR500 form, which you can then open in your preferred editor for completion.

- Begin by filling in the general information section, including your organization's name, Employer Identification Number (EIN), and contact details. This data will be used for communication and will be publicly accessible.

- Indicate the fiscal year dates by entering the starting and ending dates for your organization’s reporting period.

- If applicable, check the boxes for any changes such as address updates, name changes, or if this is an initial or final filing. Confirm your registration category (7A, EPTL, DUAL, or EXEMPT) as this will guide your filing requirements.

- Complete the certification section, ensuring it is signed by both the president or an authorized officer and the chief financial officer or treasurer as required.

- If your organization claims any annual reporting exemptions, indicate these in the designated section. Review the criteria to confirm that you qualify without the need for additional documentation.

- Review the checklist for mandatory schedules and attachments that accompany your filing. These may include IRS forms and any specific schedules related to fundraising activities.

- Calculate and enter the applicable fees based on your registration category and any claimed exemptions, ensuring that all fee entries are accurate.

- Once all sections of the form are filled out, save your changes, and prepare to download, print, or share the document as per your needs.

- Finally, send the completed CHAR500, alongside all necessary schedules and attachments, to the NYS Office of the Attorney General at the specified address.

Start filling out your CHAR500 online today and ensure your organization maintains compliance.

To start a non-profit in New York, you need to begin by selecting a unique name for your organization. Next, gather a group of individuals to serve as your board of directors. You will then prepare and file the Articles of Incorporation with the New York Department of State and apply for tax-exempt status. Additionally, you should familiarize yourself with the NY CHAR500 form, which will be essential for your financial reporting.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.