Loading

Get 2012 Form 8829 Instructions

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2012 Form 8829 Instructions online

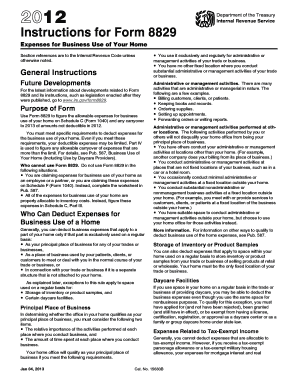

Filling out the 2012 Form 8829 can be essential for those who wish to claim expenses for the business use of their home. This guide provides a clear path to assist you in completing the form accurately and efficiently.

Follow the steps to complete Form 8829 online.

- Click 'Get Form' button to obtain the form and open it in the editor.

- Begin with Part I of the form where you will need to report the area of your home used for business. Establish this using square feet or any reasonable method that accurately reflects your business percentage on line 7.

- For lines 1 and 2, input the total square footage of the business area as well as the total square footage of your home to calculate the business percentage.

- In columns (a) and (b), enter direct expenses (specific to the business area) and indirect expenses (general home expenses). Make sure to only include expenses related to the business use of your home.

- If you're operating a daycare, follow the special computation outlined for daycare facilities to determine your business percentage accurately.

- Continue to Part II, where you will calculate the allowable deductions. Enter your gross income derived from the business use of the home on line 8.

- Further complete lines 9 to 20 by entering deductible expenses and any casualty losses applicable, as instructed in the specific guidelines.

- Proceed to Part III if applicable, to determine the depreciation percentage for your property based on when you first used your home for business.

- Finally, in Part IV, evaluate any expenses that exceed the limit for the year and determine what can be carried over to the following year. Ensure to attach all necessary schedules.

- After reviewing all entered information for accuracy, you can save changes, download, print, or share the completed Form 8829 as required.

Complete your Form 8829 online today to ensure you maximize your business expense deductions!

Filling out Form 8829 involves several steps, starting with recording your home office square footage and expenses. Refer to the 2012 Form 8829 Instructions for detailed directions on documenting your deductions. Using resources like USLegalForms can further assist you in accurately completing the form, helping you maximize your tax benefits.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.