Get It 213

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IT-213 online

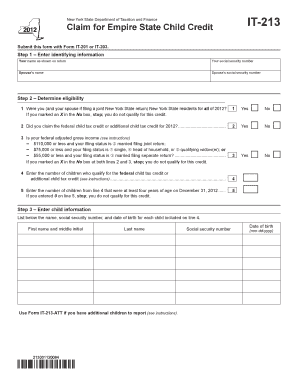

Filling out the IT-213, Claim for Empire State Child Credit, can seem daunting, but with a clear understanding of the steps involved, you can complete it efficiently. This guide will walk you through the process of filling out this form online, ensuring you have all the necessary information at your fingertips.

Follow the steps to complete the IT-213 form online.

- Click the ‘Get Form’ button to obtain the form and open it in your preferred online editor.

- Enter your identifying information, including your name as it appears on your tax return and your social security number. Additionally, provide your spouse’s name and social security number if applicable.

- Determine your eligibility by answering the following questions: 1) Were you (and your spouse, if filing jointly) residents of New York State for the entire year? If you answer 'No,' you do not qualify. 2) Did you claim the federal child tax credit or additional child tax credit in the relevant tax year? 3) Is your federal adjusted gross income within the specified thresholds based on your filing status? If you answer 'No' to both questions 2 and 3, you do not qualify. 4) Enter the number of children qualifying for the federal child tax credit. 5) Enter the number of children who were at least four years of age by the year-end; if you enter '0', you do not qualify.

- List the name, social security number, and date of birth for each child qualifying from line 4. If you have additional children to report, you may need to use Form IT-213-ATT.

- Compute your credit by entering the required values from Form 1040A or Form 1040. Follow the calculations for lines 6 through 12 carefully, ensuring to understand which calculations apply to your situation based on previous answers.

- If applicable, enter the information required for spouses who are required to file separate New York State returns. Make sure to fill lines 17 and 18 with the appropriate amounts.

- Once you have filled out all necessary fields, make sure to double-check the form for accuracy. Save your changes, and you can choose to download, print, or share the form as needed.

Complete your IT-213 form online today for the Empire State Child Credit.

The minimum salary to file an ITR varies based on your filing status and age. Generally, if your income exceeds a specific threshold, you are required to file. It’s crucial to check the latest IRS guidelines to determine your obligation. For a smooth filing experience, leverage US Legal Forms, which can help you navigate the requirements, including those related to It 213.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.