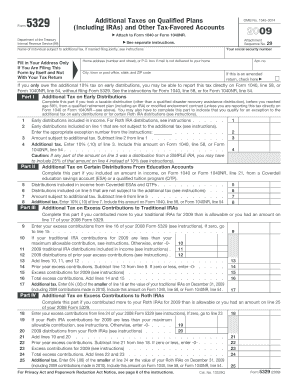

Get Form 5329 Additional Taxes On Qualified Plans (including Iras) And Other Tax-favored Accounts

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 5329 Additional Taxes On Qualified Plans (Including IRAs) And Other Tax-Favored Accounts online

Filling out Form 5329 is essential for reporting additional taxes on qualified plans, including IRAs and other tax-favored accounts. This guide will provide you with clear, step-by-step instructions on completing the form online, ensuring you meet your tax obligations and understand the various components involved.

Follow the steps to complete Form 5329 online.

- Click ‘Get Form’ button to obtain the form and open it in your preferred online editor.

- Enter your social security number and the name of the individual subject to the additional tax. If you are married and filing jointly, ensure you refer to the specific instructions provided.

- Fill in your address only if you are filing this form by itself, not with your tax return.

- If this is an amended return, tick the appropriate box.

- Complete Part I for additional taxes on certain distributions from education accounts. Input the required figures based on your financial records.

- Proceed to Part II for additional tax on early distributions. Fill in the amounts as indicated, especially if the distributions were from a qualified retirement plan.

- Continue to Part III to report additional taxes on excess contributions to traditional IRAs. Ensure all calculations are accurate as specified in the instructions.

- Follow through Parts IV, V, VI, VII, and VIII for any other applicable additional taxes. Each part focuses on different types of tax implications related to various accounts.

- Once you have completed all relevant sections, review your entries for accuracy. Corrections can be made before finalizing.

- After ensuring all information is correct, you can save changes, download, print, or share the completed form as needed.

Start filling out your Form 5329 online now to ensure you meet your tax obligations.

Someone may need to file Form 5329 to report additional taxes owed on qualified plans, including IRAs and other tax-favored accounts. Common reasons include making early withdrawals or exceeding contribution limits. Filing this form helps clarify your tax obligations and avoids penalties. Additionally, using resources like uslegalforms can simplify the process of completing this form and ensure you meet all necessary requirements.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.