Loading

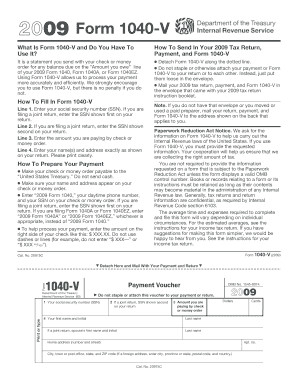

Get 2009 Form 1040-v - Craft Accounting Service

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2009 Form 1040-V - Craft Accounting Service online

Filling out the 2009 Form 1040-V is an important step in ensuring your tax payments are accurately processed. This guide provides clear and supportive instructions to help you navigate the form efficiently, whether you are familiar with tax documentation or not.

Follow the steps to complete the form correctly and submit your payment.

- Click the ‘Get Form’ button to access the 2009 Form 1040-V and open it in your preferred online editor.

- Begin filling out Line 1 by entering your social security number (SSN). If you are filing jointly, use the SSN of the primary filer.

- On Line 2, if you are filing a joint return, enter the SSN of the secondary filer.

- Proceed to Line 3 and input the total amount you are paying using a check or money order.

- For Line 4, clearly print your name(s) and address as they appear on your tax return. Ensure that it is easy to read.

- Prepare your payment by making your check or money order payable to the 'United States Treasury.' Avoid sending cash.

- Verify that your name and address are printed on your check or money order.

- Write '2009 Form 1040,' your daytime phone number, and your SSN on your check or money order to facilitate processing.

- If you are filing using Form 1040A or Form 1040EZ, adjust the description accordingly.

- After completing all fields and ensuring accuracy, save your changes. You can then download, print, or share the completed Form 1040-V.

Complete your 2009 Form 1040-V online today for a smooth tax filing process.

Form 1040 is used to report individual income tax and calculate your tax liability. This form gathers information about your earnings, deductions, and credits to determine how much tax you owe or what refund you may receive. Completing your 2009 Form 1040-V - Craft Accounting Service correctly ensures you meet your tax obligations efficiently.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.