Get Form 990 Pdf

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 990 Pdf online

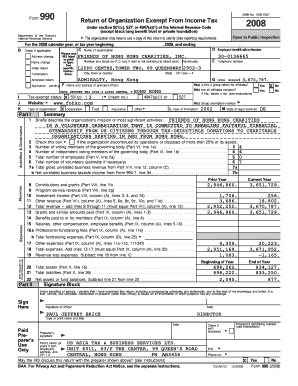

Filling out Form 990 is crucial for tax-exempt organizations to report their financial information to the Internal Revenue Service. This guide provides step-by-step instructions to assist users in completing the form accurately and efficiently.

Follow the steps to complete the Form 990 Pdf online:

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Review the organization’s details in Section C, including the name, address, and Employer Identification Number (EIN). Ensure all provided information is accurate.

- In Part I, Summary, summarize the organization’s mission and the most significant activities during the tax year.

- Complete Part II, which details specific program service accomplishments and significant changes in services.

- Fill out Part III to describe the organization’s revenue, including contributions, grants, and any other income sources. Ensure that the revenue amounts are accurately totaled.

- In Part IV, check any required schedules based on the organization’s activities, such as Schedule A for public charity status.

- Move to Part V and provide information about employment, including the total number of employees and volunteers.

- Proceed to Part VI to report on the organization’s governance, including a list of officers and board members, and ensure that appropriate processes are in place regarding conflicts of interest.

- Complete Parts VII and VIII, detailing compensation for officers, directors, and highest compensated employees.

- Finalize by reviewing the balance sheet in Part IX and ensuring all financial details match reported revenue and expenses.

- Once the entire form is complete, save changes, and download a copy for your records. You can print or share the form as required.

Begin filing your Form 990 online today to ensure compliance and transparency for your organization.

Yes, IRS 990 forms are considered public records. This means anyone can view and obtain these documents, often in a Form 990 PDF format, which provides vital information about nonprofit organizations' finances and operations. You can access these forms through the IRS website or services like US Legal Forms, which simplifies the process of finding and reviewing this information. This transparency helps promote accountability within the nonprofit sector.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.