Loading

Get Mccracken County Net Profit License Fee Return

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Mccracken County Net Profit License Fee Return online

Filling out the Mccracken County Net Profit License Fee Return online is an essential task for businesses operating in this jurisdiction. This guide provides a clear and supportive roadmap to ensure you complete the form accurately and efficiently.

Follow the steps to complete your form accurately.

- Click ‘Get Form’ button to access the Mccracken County Net Profit License Fee Return form and open it in your preferred editing tool.

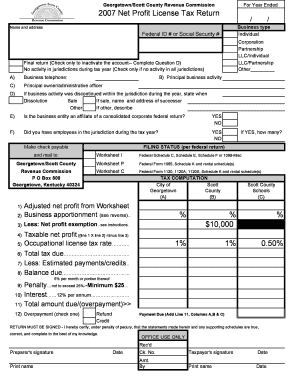

- Indicate your business type by selecting one of the options provided, such as individual, corporation, partnership, or LLC. Make sure to provide your business name and address as well as your Federal ID number or Social Security number.

- Fill in the business telephone number and the principal business activity to provide a clearer picture of your operations.

- Identify the principal owner or administrative officer of the business. If the business activity was discontinued during the year, provide the appropriate details for the dissolution or sale.

- Indicate whether your business entity is affiliated with a consolidated corporate federal return and if you had employees in the jurisdiction during the tax year.

- Proceed to the tax computation section. Use the adjusted net profit from the worksheet to calculate the taxable net profit by applying the tax rate as outlined.

- Complete the required fields for any estimated payments/credits and calculate any penalties or interest applicable, ensuring to follow the guidelines to avoid discrepancies.

- Finally, certify the return. You must sign the document and provide the date, ensuring that all the statements are true, correct, and complete. Once finalized, you will have the option to save changes, download, print, or share the form as needed.

Complete your Mccracken County Net Profit License Fee Return online today for a smooth filing experience.

To mail a Kentucky state tax return, you should send it to the address specified on the return form. Typically, this address is designated for the Kentucky Department of Revenue. When filing your McCracken County Net Profit License Fee Return, ensure you use the correct mailing address to expedite processing. US Legal Forms provides guidance on where to send your forms to avoid delays.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.