Loading

Get Oklahoma Form Sts0002

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Oklahoma Form Sts0002 online

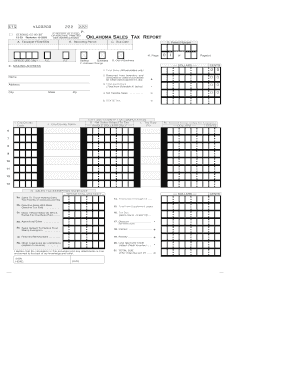

This guide provides step-by-step instructions for users on how to complete the Oklahoma Form Sts0002, the Sales Tax Report, online. Whether you are familiar with filing tax forms or new to the process, this resource aims to assist you in understanding each section clearly.

Follow the steps to successfully complete your Oklahoma Form Sts0002 online.

- Click ‘Get Form’ button to access the form and open it in the online editor.

- Enter your taxpayer federal employer identification number (FEIN) or social security number (SSN) in section A to identify your business.

- Specify the reporting period in section B. This indicates the time frame for which you are reporting sales.

- Input the due date for the report in section C to ensure timely submission.

- Provide your permit number in section D. This is necessary for identifying your sales tax permit.

- Complete section E with your current mailing address including the name of your business, street address, city, state, and zip code.

- Mark section F if there has been a change to your mailing address. Provide the new address details if applicable.

- Use section G to indicate if your business is out of operation.

- Fill in the sales figures starting from line 1 through line 5, where you detail total sales, exemptions, and calculate your net taxable sales.

- Proceed to the city and county tax computation section, completing items K through M, which involve determining the net sales subject to tax and calculating the amount of tax due.

- In section N, detail any sales that are exempt from tax by filling in the relevant lines from 3a to 3g.

- Finally, verify all information entered is correct, then save your changes, download, print, or share the completed form as required.

Complete your forms online to ensure accurate and timely processing of your Oklahoma Sales Tax Report.

Related links form

Yes, you can e-file an extension for your Oklahoma state taxes. This is a convenient option for those who need extra time to file their returns. When applying for an extension, make sure to use the Oklahoma Form Sts0002 for your submission. This form guides you through the process and helps ensure you meet all deadlines.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.