Get 2000 Form 1040 (schedule A&b) - Itemized Deductions And Interest ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2000 Form 1040 (Schedule A & B) - Itemized Deductions and Interest online

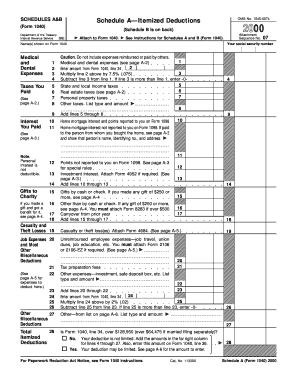

This guide provides a comprehensive overview of how to fill out the 2000 Form 1040, including Schedules A and B for itemized deductions and interest income. Whether you are new to tax forms or need a refresher, this step-by-step guide will support you through the process of completing these forms accurately and online.

Follow the steps to complete your 2000 Form 1040 (Schedule A & B) online.

- Click the 'Get Form' button to access the form and open it in your preferred editor.

- Begin with Schedule A, where you will enter your medical and dental expenses. The total amount should not include any expenses that were reimbursed or paid by others.

- Continue to fill in the state and local income taxes, real estate taxes, and any personal property taxes for the respective sections.

- For the interest you paid, ensure to include home mortgage interest and points from Form 1098. Include any relevant details if you paid interest to the seller directly.

- Proceed to report any gifts to charity, noting specific requirements for gifts of $250 or more.

- Document other unreimbursed employee expenses, tax preparation fees, and any miscellaneous deductions as applicable.

- Capitalize on the totals throughout Schedule A and ensure the final deduction amount aligns with Form 1040, line 36.

- Complete Part I of Schedule B accurately, adhering to the requirements for reporting any foreign accounts or trusts, if applicable.

Start completing your documents online today to ensure a smooth and efficient filing process.

Individuals who receive interest or dividends, have foreign accounts, or meet specific income criteria should fill out Form B. This includes many taxpayers who earn investment income or have complex financial situations. Completing this form is essential to remain compliant with IRS regulations. You can find assistance with the 2000 Form 1040 (Schedule A&B) - Itemized Deductions And Interest on platforms like uslegalforms.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.