Loading

Get Dvat

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Dvat online

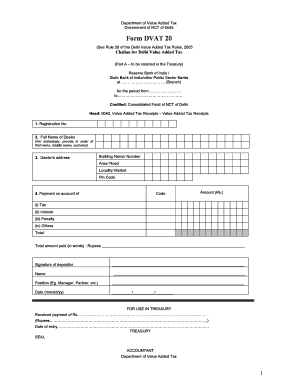

This guide aims to assist users in seamlessly completing the DVAT form online with clarity and ease. By following these instructions, users can ensure accurate submission of their Value Added Tax details.

Follow the steps to complete the DVAT form online.

- Press the ‘Get Form’ button to access the DVAT form and open it in your preferred editing tool.

- Enter your registration number in the designated field. This number is crucial for identifying your tax account.

- Provide your full name as the dealer, ensuring that you list your first name, middle name, and surname in order.

- Fill in the dealer's address, including the building name or number, area or road, locality or market, and pin code.

- In the payment section, specify the type of payment you are making by selecting the appropriate code: tax, interest, penalty, or others.

- Record the corresponding amounts for each selected payment type in the designated fields.

- Calculate the total amount and write it in both numerals and words to avoid any discrepancies.

- Sign the form, including your name and position (e.g., manager, partner) in the relevant spaces.

- Enter the date of submission in the format mm/dd/yy.

- Once all fields are accurately filled, you can save your changes, download the document, or print it for your records.

Complete your DVAT form online to ensure timely and accurate filing.

The steps for filing VAT include collecting all relevant invoices, calculating your input and output VAT, and filling out the VAT return form. Ensure that you check the Dvat guidelines specific to your region. Finally, submit your return on time to avoid any penalties. Uslegalforms offers tools to help you stay organized and compliant.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.