Loading

Get Citadel Rate Lock Request And Confirmation Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Citadel Rate Lock Request and Confirmation Form online

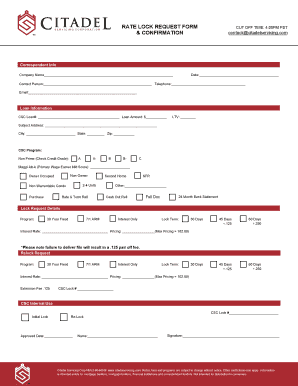

Completing the Citadel Rate Lock Request and Confirmation Form online is an essential process for securing mortgage rates. This guide provides clear steps to help users fill out the form accurately and efficiently.

Follow the steps to complete the form successfully.

- Click ‘Get Form’ button to obtain the form and open it in your preferred editor.

- Fill in the 'Correspondent Info' section by providing your company name, date, contact person details, telephone number, and email address. This information is critical for prompt communication regarding your request.

- In the 'Loan Information' section, enter the CSC loan number, loan amount, loan-to-value (LTV) ratio, and the subject address, including the city, state, and zip code. Accurate information here ensures that your loan request is processed correctly.

- Select the appropriate CSC program by checking the corresponding credit grade. You may choose between options such as Non-Prime or Maggi Alt-A, noting the primary wage earner's mid-score if applicable.

- Specify the property type by selecting from categories like non-owner occupied, owner-occupied, 2-4 units, and cash-out refinance options, among others. This information is crucial for determining eligibility and processing your request.

- In the 'Lock Request Details' section, indicate the desired program type (30 Year Fixed, 7/1 ARM, or Interest Only) and select the lock term (30, 45, or 60 days). Be sure to input the desired interest rate and pricing information as well.

- Double-check any additional details related to relock request if necessary. Fill in the program type, interest rate, pricing, and extension fee if you are requesting a relock.

- For internal use, provide necessary details that might include initials, approval dates, and signatures. Ensure this section is filled in as required for your records.

- Once you have filled out all necessary sections carefully, save your changes. You can then download, print, or share your completed form as needed.

Begin filling out your documents online now to secure your mortgage rates efficiently.

Yes, you can often extend your rate lock, but terms may vary by lender. If you are using the Citadel Rate Lock Request and Confirmation Form, you should contact your lender to discuss your options for an extension. It's essential to stay informed about any potential fees that might be associated with this process. Keeping this option in mind can help you navigate your mortgage with more flexibility.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.