Loading

Get R 1060

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the R 1060 online

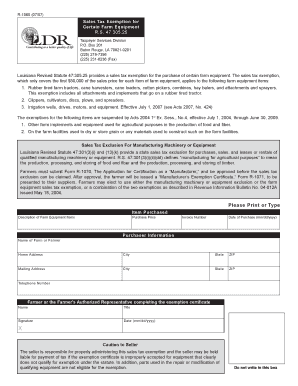

The R 1060 form allows users to claim a sales tax exemption for certain farm equipment purchases in Louisiana. This guide provides detailed instructions on how to complete the form accurately and efficiently.

Follow the steps to fill out the R 1060 form online.

- Press the ‘Get Form’ button to access the R 1060 form and open it in your preferred online editing platform.

- Provide a clear description of the farm equipment items you are purchasing in the 'Description of Farm Equipment Items' field. Ensure that you include detailed information about each item.

- Fill in the 'Name of Farm or Farmer' section with your name or the name of the farming entity to which the exemption applies.

- Enter the 'Purchase Price' of the equipment, ensuring the value does not exceed the sales tax exemption limit of $50,000 per item.

- Record the 'Invoice Number' associated with your purchase for tracking and verification purposes.

- Input the 'Date of Purchase' in the specified format (mm/dd/yyyy). Be accurate to avoid any issues with claims.

- Complete the 'Purchaser Information' section by providing your home address, city, state, and ZIP code. Ensure all information is accurate and current.

- If your mailing address differs from your home address, fill out the 'Mailing Address' section with the appropriate details.

- Include your 'Telephone Number' to facilitate communication regarding the exemption request.

- In the 'Farmer or the Farmer's Authorized Representative' section, enter the name, title, and signature of the individual completing the certificate. Also, include the date in the format (mm/dd/yyyy).

- After completing the form, ensure all required fields are filled out accurately. You may then save your changes, download the document for your records, print a hard copy, or share it as necessary.

Complete your R 1060 form online today to take advantage of the sales tax exemption for eligible farm equipment.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

To fill out an exemption certificate, begin by entering your name, address, and the tax identification number of your business. Clearly specify the type of exemption you are claiming and provide a description of the goods or services being purchased. This certificate helps you avoid unnecessary taxes. For detailed instructions, the R 1060 templates available on US Legal Forms can be very helpful.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.