Get Ptax 764 Online Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ptax 764 online form online

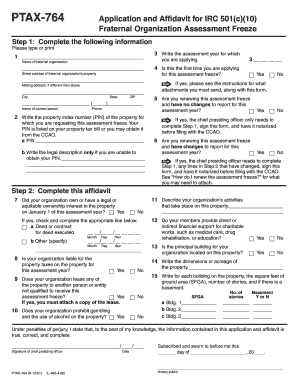

The Ptax 764 online form is a crucial document for fraternal organizations seeking an assessment freeze under IRC Section 501(c)(10). This guide provides clear, step-by-step instructions to help users navigate the form with confidence.

Follow the steps to complete the Ptax 764 online form successfully.

- Press the ‘Get Form’ button to obtain the form and open it in the editing tool.

- Begin by typing or printing your organization’s name in the first field. Ensure that the name matches the official name of your fraternal organization.

- In the second field, provide the street address of your organization’s property. This is where the assessment freeze will apply.

- Enter your property index number (PIN) of the property for which you are requesting the assessment freeze in the designated field.

- Indicate if this is your first time applying for the assessment freeze by checking the appropriate box (yes or no). If yes, review the instructions for any necessary attachments.

- Proactively answer whether you are renewing the assessment freeze with or without changes for the current assessment year.

- Complete Step 2 by describing your organization’s activities. This helps establish your organization’s purpose and alignment with assessment freeze requirements.

- Provide details regarding ownership on January 1 of the assessment year, checking ‘yes’ or ‘no’ as applicable.

- Respond to questions concerning liability for property taxes, leases, and any restrictions on gambling or alcohol on the property.

- Finalize your application by signing as the chief presiding officer, including the date and ensuring the form is notarized.

- Once all fields are filled, save your changes. You may also choose to download, print, or share the completed form as needed.

Start completing your Ptax 764 online form today to ensure you meet your application deadlines.

To apply for the Illinois homestead exemption, you need to complete the appropriate application forms, including the Ptax 764 Online Form. This form is designed to help you claim your exemption easily and efficiently. You can access the form through the US Legal Forms platform, where you'll also find guidance on how to fill it out correctly. By taking these steps, you can benefit from potential savings on your property taxes.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.