Loading

Get Fill Micro Credit Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Fill Micro Credit Form online

Filling out the Fill Micro Credit Form online is a crucial step in accessing financial support for your business. This guide will walk you through each section of the form to ensure you provide all necessary information accurately.

Follow the steps to complete the Fill Micro Credit Form online effectively.

- Click 'Get Form' button to obtain the Fill Micro Credit Form and open it in the editor.

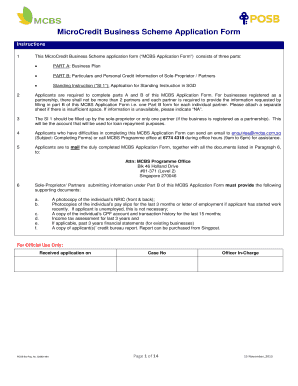

- Begin with Part A, known as the Business Plan. This section requires detailed information about your business, including the business name, registered address, and business structure. Ensure that the business name is accurate and corresponds with your official records.

- In Section 1 of Part A, provide your business information, including ACRA registration number and contact details. Make sure to fill in all fields completely to avoid delays in processing.

- Next, move to Section 2 to clarify the business structure. Indicate whether you are a sole proprietor or partnership and include details about partners if applicable.

- Proceed to Section 3 and specify the loan request, detailing the amount you wish to borrow and the purpose of the loan. Ensure that the amount requested falls within the allowable range of S$3,000 to S$50,000.

- In Section 4, provide details about the management of your business including pertinent experience that supports your application.

- Continue to Section 5, where you will present a comprehensive overview of your business plan, including product descriptions, target market, and pricing strategy.

- In Section 6, break down the costs associated with your business project or expansion, detailing all anticipated expenditures.

- Once you've completed Part A, proceed to Part B. Here, each sole proprietor or partner must fill out personal information such as name, NRIC number, and contact details.

- Review all sections thoroughly to ensure accuracy. If there is not enough space for any information, feel free to attach additional sheets, clearly referenced.

- Finally, save your changes, and download or print the completed form for submission. Be sure to include any supporting documents as mentioned in the instructions.

Start filling out your Fill Micro Credit Form online today to take the first step towards securing funding for your business.

A credit information form is a document that collects information about your financial history and current credit status. It helps lenders evaluate your eligibility for credit products. By using uslegalforms, you can easily access templates and guidance to fill Micro Credit Form correctly.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.