Loading

Get Rc4607 Fillable Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Rc4607 Fillable Form online

Filling out the Rc4607 Fillable Form online can be straightforward if you follow the right steps. This guide provides a detailed walkthrough of each section and field to assist you in completing the form correctly.

Follow the steps to fill out the Rc4607 Fillable Form successfully.

- Press the ‘Get Form’ button to access the Rc4607 Fillable Form and open it in your preferred editor.

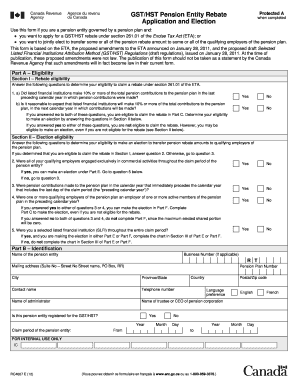

- In Part A, determine your eligibility by answering the questions in Section I about rebate eligibility. Respond 'Yes' or 'No' as applicable.

- If eligible for the rebate, continue to Part C to calculate the rebate amounts. Enter the needed values for GST/HST paid, payable, and deemed amounts as specified.

- In Part B, provide your identification details including the name of the pension entity, Business Number (if applicable), and contact information.

- Complete Part D, certifying the accuracy of the information provided in your application with the signature of the authorized person.

- If making an election, fill out either Part E or Part F as applicable for qualifying employers engaged exclusively in commercial activities or not. Provide the necessary figures and details.

- Review all sections for completeness and accuracy before proceeding to save or print your form.

- Once reviewed, save your changes, then save, download, or print the completed form as needed.

Start completing your documents online today for a seamless filing experience!

The application is meant for the taxpayer where the amount intended to be paid is debited from his account but CIN has not been conveyed by bank to Common Portal or CIN has been generated but not reported by concerned bank. The application may be filed if CIN is not conveyed within 24 hours of debit.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.