Get T1036 Hbppdf Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the T1036 Hbppdf Form online

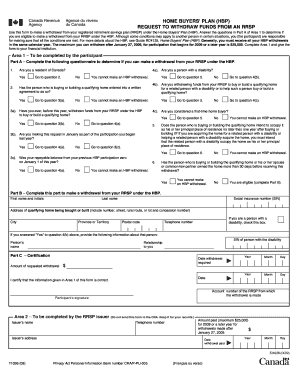

The T1036 Hbppdf form is essential for individuals wishing to withdraw funds from their registered retirement savings plan (RRSP) under the Home Buyers' Plan (HBP). This guide will walk you through the process of completing the form online, ensuring you understand each step involved.

Follow the steps to fill out the T1036 Hbppdf form effectively

- Click the ‘Get Form’ button to access the T1036 Hbppdf form and open it in your editor of choice.

- In Area 1, start with Part A by answering the eligibility questionnaire. You will provide details about your residency in Canada and if you are a person with a disability.

- Continue through the questions in Part A, responding to inquiries about prior withdrawals and your intention for the qualifying home being purchased or built.

- If you determine eligibility, proceed to Part B. Fill in your personal details, including your social insurance number, full name, and address of the home.

- Complete all required information for any related person with a disability, if applicable, as per the guidelines in Part B.

- In Part C, indicate the amount you wish to withdraw and the date you require the funds. Then provide your signature to certify correctness.

- Finally, ensure you save changes, download, print, or share the completed form as needed, keeping a copy for your records.

Start filling out the T1036 Hbppdf form online today and take another step towards your home ownership journey.

Related links form

To file for the Home Buyers' Plan (HBP), you must first complete the T1036 Hbppdf Form. This form allows you to withdraw funds from your Registered Retirement Savings Plan (RRSP) to buy or build a qualifying home. You can submit the T1036 form through your tax return or file it separately. Make sure to keep track of your withdrawals to ensure compliance with repayment terms.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.