Get Applicaiton For Certificate Of Competence Tax Holiday For Foreign Researchers Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Application For Certificate Of Competence Tax Holiday For Foreign Researchers Form online

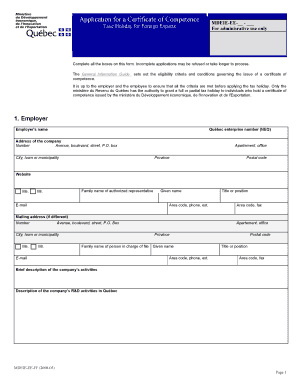

Completing the Application for Certificate of Competence Tax Holiday for Foreign Researchers form online can streamline the process of securing a tax holiday for eligible candidates. This guide outlines the necessary steps to accurately fill out and submit the form, ensuring you meet all eligibility requirements.

Follow the steps to complete the form effectively.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by filling in the employer's information section. This includes the employer's name, Quebec enterprise number (NEQ), and the full address of the company, including city, province, and postal code. Also, provide the website and the contact details of the authorized representative.

- Complete the candidate's information section. Fill in the candidate's name, Social Insurance Number, and details regarding their anticipated contract duration and start date. Additionally, specify the candidate's city and country of residence before starting the employment and their citizenship.

- Describe the candidate's training by listing postsecondary diplomas obtained, along with the fields, years, universities, cities, and countries.

- Provide a detailed description of the anticipated position for the candidate, including the location of R&D activities and a summary of their responsibilities.

- Elaborate on how the anticipated duties correlate with the candidate's qualifications. This section is essential to demonstrate the candidate's fit for the role and their specific qualifications relative to the expected duties.

- Optional: Fill in any additional information about the candidate, such as age, place of birth, civil status, and annual salary.

- Review and confirm the commitment of both parties by understanding the conditions that apply to the tax holiday for foreign experts. Sign the statement by the company's representative and the candidate, including the date and name in block letters.

- Ensure that all required documents are enclosed with the application. This includes the candidate’s full curriculum vitae, a certified copy of the most recent relevant diploma, and any other specified documents.

- Once all sections are completed, save changes, download, print, or share the application form as necessary to finalize the submission.

Start completing the Application for Certificate of Competence Tax Holiday for Foreign Researchers Form online today.

Related links form

To apply for a TRC certificate, you will need to fill out the Application For Certificate Of Competence Tax Holiday For Foreign Researchers Form. Start by gathering the necessary documents, such as your identification and proof of residency. Once you complete the form, submit it to the relevant tax authority. For a smoother process, consider using the resources available on the uslegalforms platform.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.