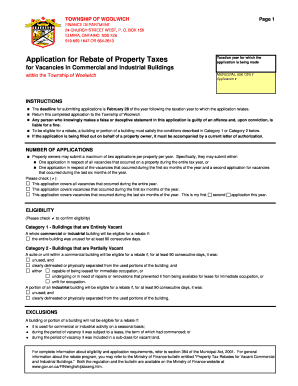

Get Vacancy Rebate Application - Township Of Woolwich

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Vacancy Rebate Application - Township of Woolwich online

Filling out the Vacancy Rebate Application for the Township of Woolwich online is a straightforward process designed to help property owners claim tax rebates for vacancies in commercial and industrial buildings. This guide provides step-by-step instructions to ensure that you complete the application accurately and efficiently.

Follow the steps to complete your application online effectively.

- Click the ‘Get Form’ button to obtain the Vacancy Rebate Application form and open it for editing.

- Indicate the taxation year for which you are applying for the rebate. This information is vital for processing your application.

- Choose the type of application you are submitting by checking the appropriate option: whether it covers all vacancies for the year or specific periods within the year.

- Confirm your eligibility status by selecting from the eligibility categories provided, which include entirely vacant buildings or partially vacant buildings.

- Fill out the property information section, including the roll number, property address, owner's name, and representative's details if applicable.

- Provide a description of the vacant area, including size and any specific identifiers like unit or floor numbers.

- Document the period of vacancy, ensuring it meets the required minimum of 90 consecutive days, by entering the respective start and end dates.

- Review your application thoroughly to confirm all information is accurate and complete.

- Once satisfied, save your changes, and choose to download or print the form for submission. Ensure that you return the completed application to the Township of Woolwich.

Complete your Vacancy Rebate Application online today to secure your property tax rebate!

Related links form

The Wellington County tax rebate is a program designed to assist property owners by providing tax relief based on specific conditions. By completing a Vacancy Rebate Application - Township Of Woolwich, eligible residents can receive a portion of their property taxes back during vacant periods. This initiative helps keep properties in good condition and supports local communities.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.