Loading

Get Alberta Loss Carry-back Application - Alberta Finance And Enterprise - Finance Alberta

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Alberta Loss Carry-back Application - Alberta Finance And Enterprise - Finance Alberta online

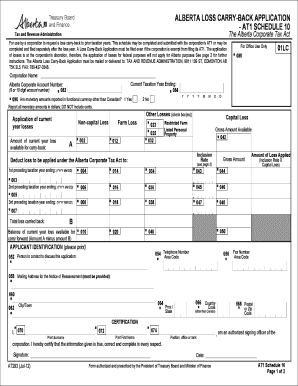

The Alberta Loss Carry-back Application is a crucial form for corporations seeking to carry back losses to prior taxation years. This guide provides step-by-step instructions to help users complete the application accurately and efficiently.

Follow the steps to fill out your Alberta Loss Carry-back Application online.

- Click the ‘Get Form’ button to access the Alberta Loss Carry-back Application and open it in your chosen digital platform.

- Begin by entering the corporation name in the designated field. This is essential for identification purposes.

- Input the current taxation year ending date in the provided format to specify which tax year you are applying for.

- Enter the Alberta corporate account number, ensuring it is either 9 or 10 digits long. This number connects your application to your corporate tax file.

- Indicate whether the monetary amounts are reported in a functional currency other than Canadian dollars by checking ‘Yes’ or ‘No.’ Make sure all amounts are reported in whole dollars; do not include cents.

- Report the amount of current year loss available for carry-back. Specify the type of loss, choosing from non-capital loss, capital loss, farm loss, restricted farm loss, or listed personal property.

- For each previous taxation year, provide the ending dates and apply the losses accordingly. Ensure that you calculate the total loss carried back accurately.

- Complete the applicant identification section by providing the contact person's information, including their telephone number and fax number. Be certain to indicate a mailing address for the notice of reassessment.

- In the certification section, the authorized signing officer must print their name, position, and provide a signature along with the date. This certifies the information is accurate.

- After reviewing the completed form for accuracy, save your changes. You may also choose to download, print, or share the application as needed.

Ensure your losses are properly documented by completing your Alberta Loss Carry-back Application online today.

You can contact Alberta Finance Tax and Revenue Administration through their official website or by phone. They provide resources and assistance for those needing help with their Alberta Loss Carry-back Application - Alberta Finance And Enterprise - Finance Alberta. Make sure to have your tax information ready to expedite the process.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.