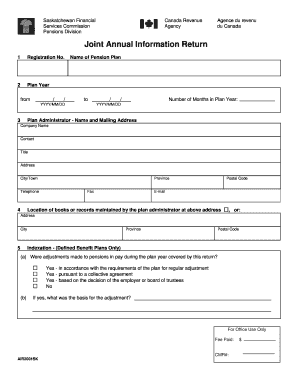

Get Saskatchewan Financial Service Commission Pensions Division Joint Annual Information Return

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Saskatchewan Financial Service Commission Pensions Division Joint Annual Information Return online

This guide provides a clear and supportive approach to completing the Saskatchewan Financial Service Commission Pensions Division Joint Annual Information Return online. Whether you are an experienced user or new to digital document management, this step-by-step guide will assist you in accurately filling out the required fields.

Follow the steps to complete the return successfully.

- Press the ‘Get Form’ button to access the form and open it for completion.

- Enter the registration number of the pension plan in the designated field.

- Indicate the plan year by filling in the start and end dates in the specified format (YYYY/MM/DD).

- Provide the name and mailing address of the plan administrator, including the company name, contact's title, address, city, telephone number, fax number, postal code, and email.

- Detail the location of books or records maintained by the plan administrator, or enter an alternative address if applicable.

- For defined benefit plans, answer the indexation question by selecting one of the options that best describes any adjustments made to pensions in pay during the plan year.

- Fill in member contributions due for the plan year under the specified sections for required and voluntary contributions, calculating the total.

- Provide employer contributions information, excluding special payments, and detail any surplus assets used during the reporting period.

- Complete the section on surplus utilization if applicable, confirming if written notice was provided regarding the use of surplus assets.

- Report the plan's total membership, including number of active members, new entrants, exits, and the total number of pensioners and beneficiaries.

- Fill out the jurisdiction of employment for active members, providing detailed statistics concerning gender and included employment.

- List plan expenses, including administrative expenses paid directly from the pension fund.

- Address investment information questions, confirming if the plan has a compliant written statement of investment policies and procedures.

- Certify the accuracy of the information provided, including signatures and dates from the appropriate representatives.

- Review all entered information for accuracy and completeness before proceeding to save changes, download, print, or share the completed form.

Complete your Saskatchewan Financial Service Commission Pensions Division Joint Annual Information Return online today!

In Saskatchewan, the Old Age Security (OAS) pension can provide you with a monthly amount that varies based on your income and residency. As of now, the maximum monthly OAS payment is around $600, but it can be reduced if your income exceeds certain thresholds. Understanding how the Saskatchewan Financial Service Commission Pensions Division interacts with OAS can help you plan your retirement better. For detailed information and assistance, consider visiting US Legal Forms for tailored resources.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.