Get Ifta Manitoba

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ifta Manitoba online

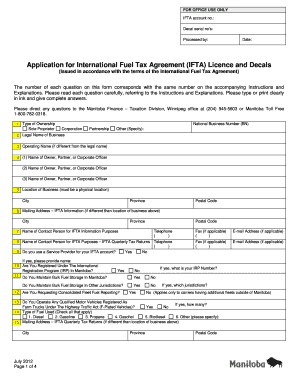

Filing for an International Fuel Tax Agreement (IFTA) licence and decals in Manitoba can seem daunting, but it can be navigated easily with the right guidance. This comprehensive guide will walk you through each section of the IFTA Manitoba form to ensure a smooth submission process.

Follow the steps to complete your IFTA Manitoba application online.

- Click ‘Get Form’ button to obtain the form and open it in your preferred document editor.

- Choose the type of ownership for the business. Select one of the options: 'Sole Proprietor,' 'Corporation,' 'Partnership,' or 'Other' and, if applicable, provide your National Business Number.

- Enter the legal name of your business exactly as registered with the appropriate authorities in the specified field.

- If different from the legal name, fill in the operating name of your business, the name your customers recognize.

- Add the names of the owner, partner, or corporate officer. At least one name is required, and you may add additional names on a separate sheet if needed.

- Indicate the physical location of your business, ensuring to provide the full address including city, province, and postal code.

- If the mailing address for IFTA information differs from your business location, please fill in this section with the appropriate details.

- Provide the name and contact details of the primary person to liaise with IFTA information matters, including telephone and email.

- List the contact person for IFTA purposes specifically for quarterly tax returns, including their contact details.

- If applicable, state if you use a Service Provider for your IFTA account and provide their name.

- Indicate whether you are registered under the International Registration Program (IRP) in Manitoba.

- Mark whether you maintain bulk fuel storage in Manitoba or in other jurisdictions, providing details if applicable.

- Respond to whether you’re requesting consolidated fleet fuel reporting, including any necessary IRP numbers if applicable.

- Identify the types of fuel used for your business. Check all that apply, ensuring comprehensive reporting.

- Fill out the mailing address for IFTA quarterly tax returns if it differs from the location of the business.

- Indicate if you are registered for retail sales tax in Manitoba and provide your account number if applicable.

- If you have been registered under IFTA in any jurisdiction previously, please note the relevant details.

- Calculate the annual licence and decal fees, entering the total amount to submit with your application.

- Finally, sign the certification section, ensuring it is completed by an authorized individual. If signed by a representative, attach the required letter of authorization.

- Once all fields are completed, review your form for accuracy. You may then save the changes, download, print, or share the completed application as necessary.

Complete your IFTA Manitoba application online today to ensure compliance and efficient processing.

Related links form

IFTA requirements include maintaining accurate records of mileage and fuel purchases, filing quarterly tax returns, and paying any taxes owed. Each jurisdiction may have specific regulations, so reviewing IFTA Manitoba guidelines is essential. Compliance with these requirements helps you avoid penalties and ensures smooth operations. US Legal Forms offers valuable resources to assist you in understanding and fulfilling your IFTA obligations.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.