Loading

Get Bsf715

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Bsf715 online

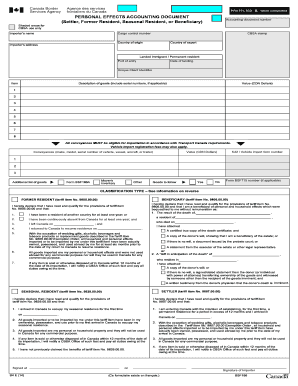

Filling out the Bsf715 form is a crucial step for individuals returning to Canada or dealing with personal effects. This guide provides clear instructions to help you navigate each section of the form with ease.

Follow the steps to fill out the Bsf715 effectively.

- Press the ‘Get Form’ button to access the Bsf715 form and open it in your preferred form editor.

- Begin by filling in your personal information. Include your name and address, and ensure the details are accurate to avoid any issues.

- In the appropriate sections, provide the accounting document number and cargo control number assigned to your importation.

- List your personal effects in the designated areas. Describe each item thoroughly, including serial numbers and the value in Canadian dollars.

- If applicable, fill in details about any conveyances, such as vehicles or vessels, including their make, model, and serial numbers.

- Indicate if you are a settler, former resident, or seasonal resident by checking the respective box and completing any required declarations.

- Carefully read the declarations regarding your eligibility for the tariff exemptions and mark your understanding and agreement.

- After completing the form, review all entries for accuracy. Make any necessary corrections before finalizing.

- Save your changes, and then choose to download, print, or share your completed form as needed.

Take the next step and confidently complete the Bsf715 form online.

Clearing customs without a broker in Canada is possible, but you will need to understand the process. First, gather all necessary documentation, including your BSF715 form, and be prepared to declare your goods. You can use resources like US Legal Forms to find guidance and templates that help you navigate customs without a broker, ensuring a smooth experience.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.