Loading

Get 3559 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 3559 Form online

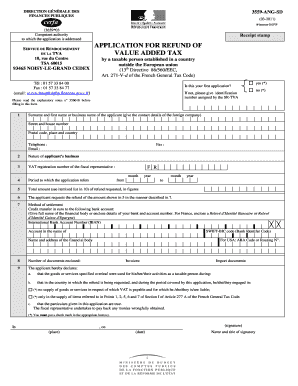

Filling out the 3559 Form online can be a straightforward process if you follow the correct steps. This guide aims to provide clear and concise instructions to assist users in completing the form accurately to ensure a successful application for a refund of value added tax (VAT).

Follow the steps to complete the 3559 Form online.

- Click the ‘Get Form’ button to obtain the 3559 Form and open it in your editor for online completion.

- Begin with the 'Competent authority' section. Ensure you provide the correct details of the authority to which the application is addressed, which can be found at the top of the form.

- Indicate if this is your first application by selecting 'yes' or 'no.' If applicable, provide the identification number assigned by the SR-TVA.

- Fill in your name or business name, along with your contact information, including your street address, postal code, country, telephone, email, and fax if available.

- Specify the nature of your business in the designated field, providing relevant details as necessary.

- Enter the VAT registration number of the fiscal representative clearly and accurately.

- Provide the period that your application refers to by entering the start and end dates in month/year format.

- In the area for the total amount requested, enter the figures accurately based on your itemized list, which you will detail in section 10.

- Indicate your preferred method of settlement. Specify bank account information, including account number, IBAN, and the name and address of your banking institution.

- List the number of documents you are enclosing with the application for completeness.

- Make the required declarations regarding the use of goods or services, checking the appropriate boxes that apply to your situation.

- Ensure the declaration of truthfulness is completed by signing, stating your name, title, and the date.

- In section 10, provide the details of items related to VAT, including suppliers, invoice dates, and amounts.

- Once all fields are filled out correctly, save your changes, and download or print the form as necessary. You may also share it if required.

Complete your documents online confidently and efficiently.

You can obtain a Medicaid form from your state’s Medicaid website or local office. Alternatively, US Legal Forms offers a variety of Medicaid forms, including the 3559 Form, to help simplify the application process. By accessing these resources, you can ensure that you have the correct forms needed to apply for Medicaid.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.