Loading

Get Inheritance Letter

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the INHERITANCE LETTER online

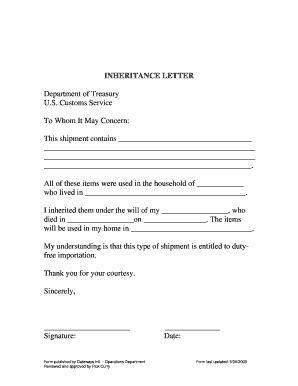

The INHERITANCE LETTER is an important document required for the duty-free importation of inherited household items. This guide will help you navigate the form step by step, ensuring that you complete it accurately and efficiently.

Follow the steps to accurately fill out the INHERITANCE LETTER.

- Click the ‘Get Form’ button to access the INHERITANCE LETTER and open it for editing.

- In the first blank space, fill in a detailed description of the items you are inheriting. Be as specific as possible to ensure clarity.

- In the next blank, indicate the name of the individual from whom you inherited the items. This should be the person whose will grants you inheritance.

- Provide the address where the individual lived. This information is necessary for processing your request and validating the inheritance.

- In the subsequent field, mention your relationship to the decedent. Use neutral terms such as 'partner' or 'relative' as applicable.

- Record the date of death of the individual you inherited from. Ensure that this date is accurate to avoid any confusion during processing.

- Fill in the date you are completing this form at the end of the document.

- Finally, add your signature to the designated space to validate the document. This confirms that the information provided is truthful.

- After completing the form, ensure you save any changes. You can download, print, or share the completed INHERITANCE LETTER as needed.

Complete your documents online and ensure a smooth process for your inherited items.

To claim your inheritance, you need the inheritance letter, a death certificate, and identification. The inheritance letter is crucial as it details your claim and rights to the estate. Having these documents ready can facilitate a smoother process in claiming your rightful inheritance.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.