Get Syi01 Standard Life Investment Options Guide Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Syi01 Standard Life Investment Options Guide Form online

The Syi01 Standard Life Investment Options Guide Form is essential for individuals seeking to apply for investment options within a retirement fund. This guide will walk you through each section of the form, ensuring that you can complete it effectively and efficiently online.

Follow the steps to successfully complete your investment options form.

- Click ‘Get Form’ button to download the form and open it for completion.

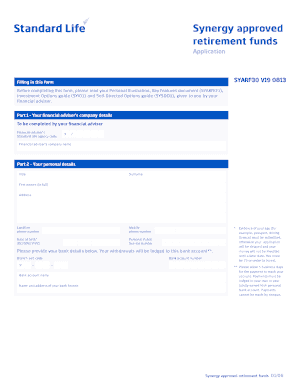

- Begin with Part 1, where your financial adviser needs to fill in their company details, including the agency code and company name.

- Proceed to Part 2, which requires your personal details. Fill in your title, surname, full first names, address, landline, mobile, date of birth, and Personal Public Service number. Ensure that all information is accurate and up-to-date.

- Next, provide your bank details as withdrawals will be processed to this account. Include your bank's branch sort code and account number, along with the account name and the branch address.

- In Part 3, address the ARF eligibility questions. You'll need to verify whether you have an existing ARF or Vested PRSA, and if not, confirm your guaranteed pension income.

- For Part 4a, determine your ARF income amount. You must indicate how much you intend to withdraw annually and select a withdrawal frequency.

- In Part 4b, you will specify whether you have appointed a nominee Qualifying Fund Manager. If yes, complete the required details.

- Proceed to Part 5a to declare your intended investment amounts for both ARF and AMRF, ensuring you adhere to the minimum investment requirements.

- For Part 5b, allocate your investments as per the options listed in the Investment Options guide (SYI01) and the Self-Directed Options guide (SYSDO1). Indicate how your premiums will be distributed across different funds.

- If applicable, fill out Part 6a related to your occupation and income bracket and Part 6b with proof of identity and address, as compliance with money laundering regulations is essential.

- In Part 7, your financial adviser must confirm their assistance and provide their signature, affirming the advice given during your application process.

- Finally, review the checklist in Part 8 to ensure that all necessary sections are completed, and sign the declaration in Part 9. Provide your email address for later access to your policy online.

- Save your changes to the form and ensure you have the option to download, print, or share it as needed.

Complete your Syi01 Standard Life Investment Options Guide Form online today for a seamless investment experience.

Standard Life has a strong reputation in the pension market and offers a variety of options tailored to different financial needs. Many customers appreciate the flexibility and range of investment choices available, which can be explored further in the Syi01 Standard Life Investment Options Guide Form. Ultimately, whether it suits you depends on your individual retirement goals and risk tolerance.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.