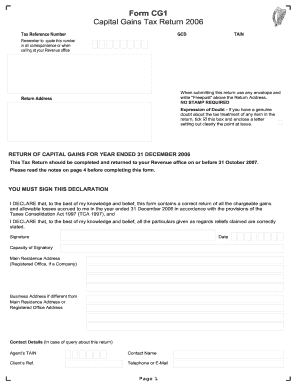

Get Form Cg1 Aggregate Consideration

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form Cg1 Aggregate Consideration online

This guide provides a comprehensive overview of how to complete the Form Cg1 Aggregate Consideration online. Whether you are a seasoned taxpayer or new to these forms, this step-by-step process will help ensure all necessary details are accurately captured.

Follow the steps to successfully complete the form.

- Click ‘Get Form’ button to access the form and open it in your preferred editor.

- Begin by entering your Tax Reference Number at the top of the form. This number is essential for processing your return, so ensure it is entered correctly.

- In the section labeled 'Details of Disposal of Assets,' you will need to record the number of disposals, area in hectares, and the aggregate consideration for each category like quoted shares, unquoted shares, offshore funds, commercial premises, and so on. Fill in this information accurately.

- Indicate any disposals made between connected persons or at non-arms length in the designated section, ensuring all relevant boxes are ticked.

- Proceed to the Claim to Reliefs section. Here, specify any reliefs you are claiming for yourself and your spouse, along with the corresponding amounts of consideration.

- Continue with the sections pertaining to chargeable gains, previous gains, net losses, personal exemptions and ensure that you enter the appropriate figures as they apply to your circumstances.

- After reviewing, save the completed form, and choose to download or print it to keep a copy for your records.

- Finally, you may share the form as needed or submit it according to the guidelines provided in the notes section.

Fill out your Form Cg1 Aggregate Consideration online today to ensure timely submission and compliance with tax regulations.

One effective method to avoid capital gains tax on real estate investments involves utilizing a 1031 exchange. This strategy allows you to defer taxes by reinvesting proceeds from a sold property into a similar kind of property. It's important to follow the guidelines meticulously to qualify for this benefit. For comprehensive assistance and resources, you can explore solutions available at US Legal Forms, which can help facilitate this process.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.